Preliminary results from the November 2021 Colorado general election were a mixed bag. Voters rejected all three statewide ballot measures:

- Amendment 78, which sought more legislative oversight on spending

- Proposition 119, to increase state taxes by $137.6 million on retail marijuana; and

- Proposition 120, which would have lowered property tax assessment rates for multifamily housing and lodging properties.

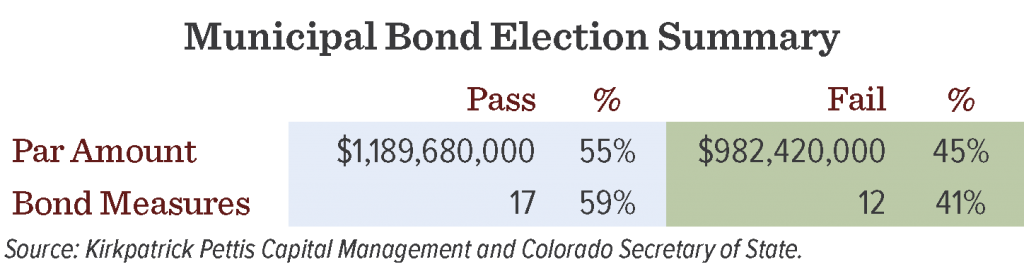

Although results have yet to be certified and are still considered to be preliminary, nearly $1.2 billion of General Obligation bonds were approved by Colorado voters. While this election was generally deemed a success for local governments when compared with the November 2020 election, which approved $1.6 billion of issuance, one may say this election fell a bit short. By election measure, approximately 59% of issues were approved, which represents 55% of the total requested par amount (see below).

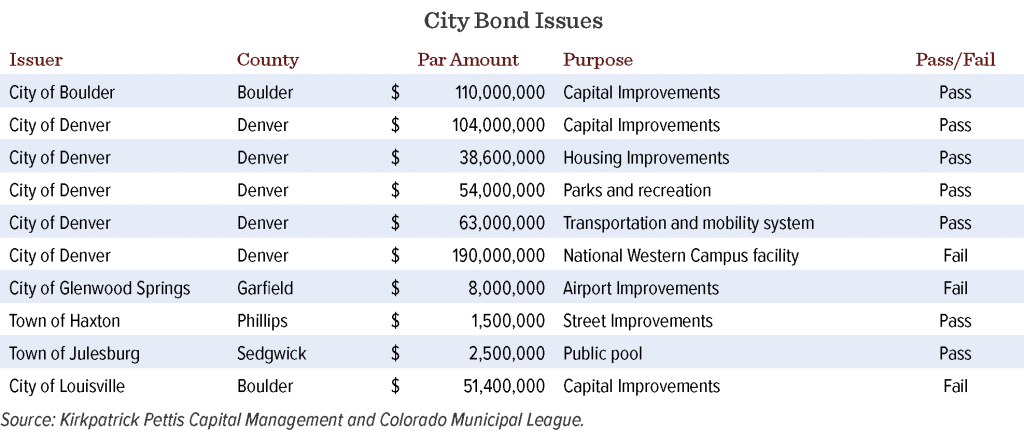

There were more than 100 municipal ballot measures on the November 2, 2021 election in Colorado. Ballot measures covered housing, broadband, bond proposals for public improvements, economic development, governance, homelessness, marijuana, tax increases, property tax rate adjustments, election changes, and charter amendments. All five TABOR over-ride ballot measures were approved by voters, in addition to $373.6 million of city bond issues.¹

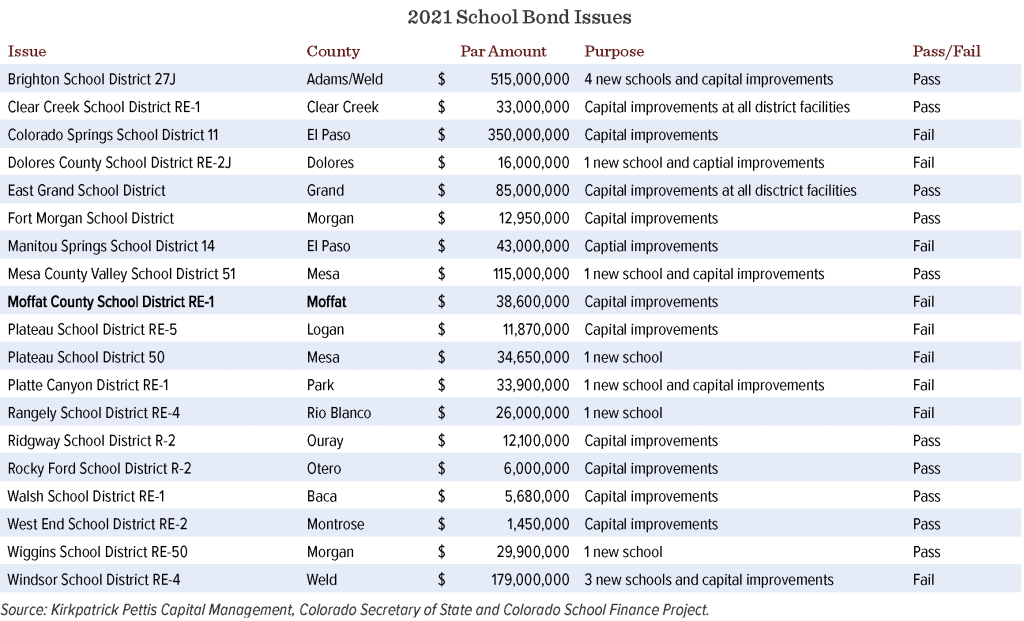

Colorado voters were faced with $1.5 billion of school bond issues in 19 school district elections, comparable to the $1.5 billion school districts requested from voters in 2020. School district bond issues on the ballot ranged from $1.5 million to $515 million. Voters approved 10 of the 19 school district bond issues for $816.1 million that will fund new schools and capital improvements. In addition, voters also approved $9.0 million in school district Mill Levy overrides. Historically, Colorado voters have shown a willingness to approve the majority of local bond measures, the success of school bond issues this year were lower than in most past years.²

Overall, voters continue to demonstrate a willingness to approve local bond measures, which provide new schools and other capital improvements throughout the state. We believe results of these elections should provide the Aquila Tax-Free Fund of Colorado with a broad opportunity to invest in a variety of projects as bonds are sold later this year and into 2022.

Disclosures

¹The Taxpayer’s Bill of Rights (“TABOR”) Amendment was approved by voters in 1992. This amendment to the Constitution of the State of Colorado limits the amount of revenue the state can retain. The TABOR limit is equal to the lesser of the prior fiscal year’s revenue limit plus the rate of inflation and population growth in Colorado or the current fiscal year’s revenue. Also, the TABOR Amendment requires voter approval for certain tax increases.

²Mill Levy Correction refers to a legal and legislative directive to correct an interpretation of statute by CDE that led to a historical under collection of property taxes in education in Colorado school districts. Mill Levy Correction was implemented starting in the 2021 tax year.

This document is provided for informational purposes only. It is not intended to represent a recommendation to buy or sell any particular investment or security.

Mutual fund investing involves risk; loss of principal is possible. Investments in bonds may decline in value due to rising interest rates, a real or perceived decline in credit quality of the issuer, borrower, counterparty, or collateral, adverse tax or legislative changes, court decisions, market or economic conditions. Fund performance could be more volatile than that of funds with greater geographic diversification.

Before investing in the Fund, carefully read about and consider the investment objectives, risks, charges, expenses and other information found in the Fund prospectus. The prospectus is available from your financial professional, and when you call 800-437-1020 or visit www.aquilafunds.com.