The art and practice of picking individual municipal bonds can be a lot like picking apples. Finding great values or a real gem is primarily a function of market conditions and variety. If one has a discerning taste in apples they are more likely to encounter a wider variety of in season, locally grown apples at a farmers market rather than at Costco. With municipals, it’s always easier to obtain value when there is wide variety of both the types of bonds available and sellers willing to trade.

In today’s municipal bond market, demand is strong (not much variety in sellers) and yields are compressed across the yield curve (not much variation among yields), making it more difficult to find a great individual bond value. Combining this with the shift in Fed policy that has moved from tightening to easing in a matter of months, interest rates have been driven lower with a magnitude and speed that has resulted in the market yields of some individual bonds falling much further than the distribution yield of a diversified mutual fund portfolio.

In a market like we are experiencing today, the most attractive municipal bond values may actually be found in established, well diversified municipal bond mutual fund portfolios. This applies to both establishing new exposure to municipal bonds in an asset allocation, and to reinvesting maturity proceeds or making additions to an existing fixed income portfolio.

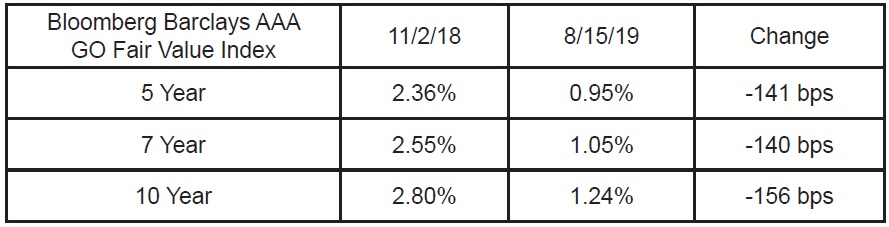

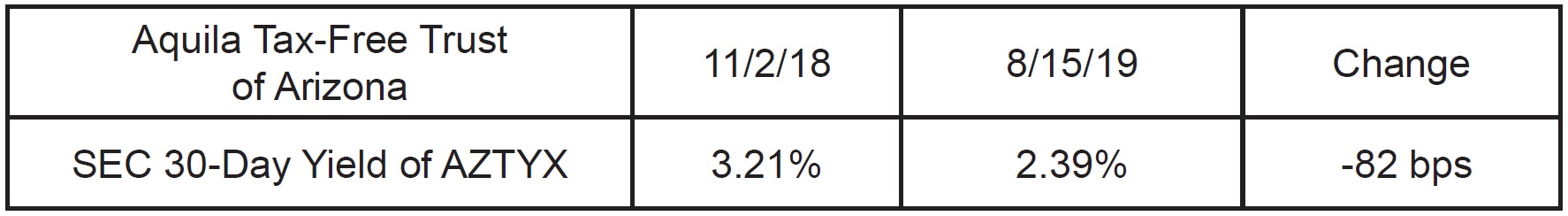

In comparing the change in intermediate market yields of some individual bonds with the yields of Aquila Tax-Free Trust of Arizona (AZTYX) for example, there is now a substantially larger yield advantage in the Fund. After peaking the first week of November 2018, market yields of individual bonds across the intermediate yield curve have fallen dramatically.

while the SEC 30-Day yield of AZTYX has held up better (please read the Fund prospectus here):

This can be attributed to a couple factors. First, active portfolio management may enable a fund manager to better sustain the portfolio income and dividend of a mutual fund by capitalizing on the opportunities that fluctuating interest rates often present (sort of like having a personal shopper at the muni bond “farmers market”). Second, the market yield and price change of an individual bond is more sensitive to a change in market yields than the yield and price change for a diversified portfolio of bonds.

That is because the average maturity and duration of a portfolio of bonds is not the same as the actual maturity and duration of any one specific bond.

A Working Example

The value comparison can be made from two vantage points in comparing an individual bond purchase to buying shares in a municipal bond fund. This involves looking in the context of the classic risk/return trade-off of income vs. duration.

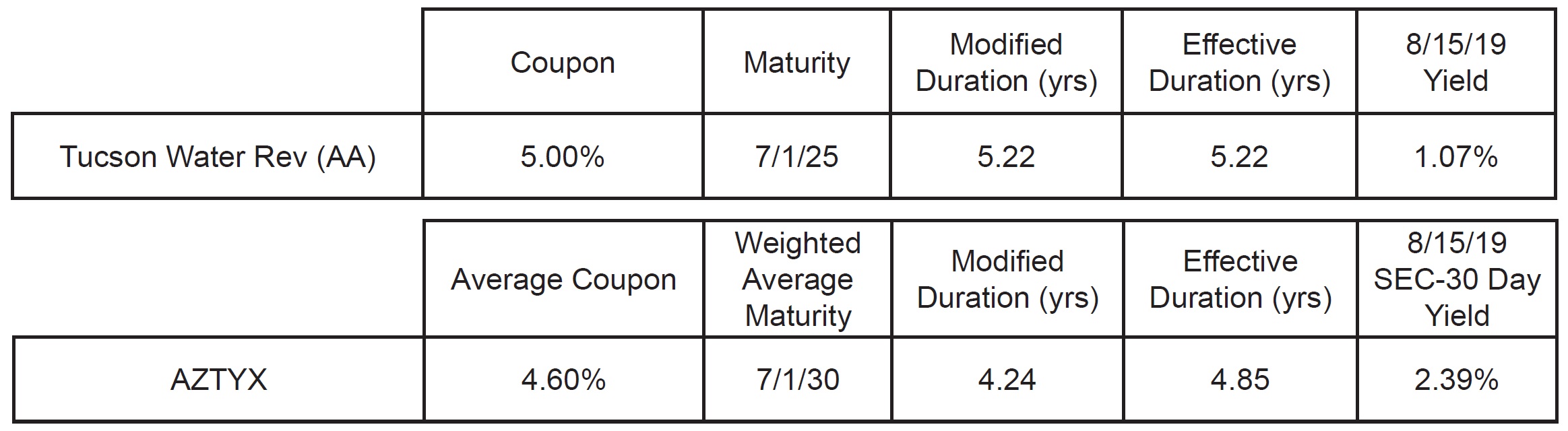

In one case, the value can be looked at as “what is my income advantage for a bond or a bond fund of similar duration”. This would most correlate with comparing a six year non-callable individual muni bond to AZTYX. As a rule of thumb for non-callable, 4%-5% coupon bonds maturing in 10 years or less, duration is equal to approximately 80%-85% of stated final maturity.

In this case, the fund provides 132 basis points, over twice the yield of an individual bond with equal risk at time of purchase. While the risk comparison improves for the individual bond as it approaches maturity and its duration declines over time, this comes at an opportunity cost per year of 132 basis points, or 7.92% of total tax-free income over the 6 year life of the bond.

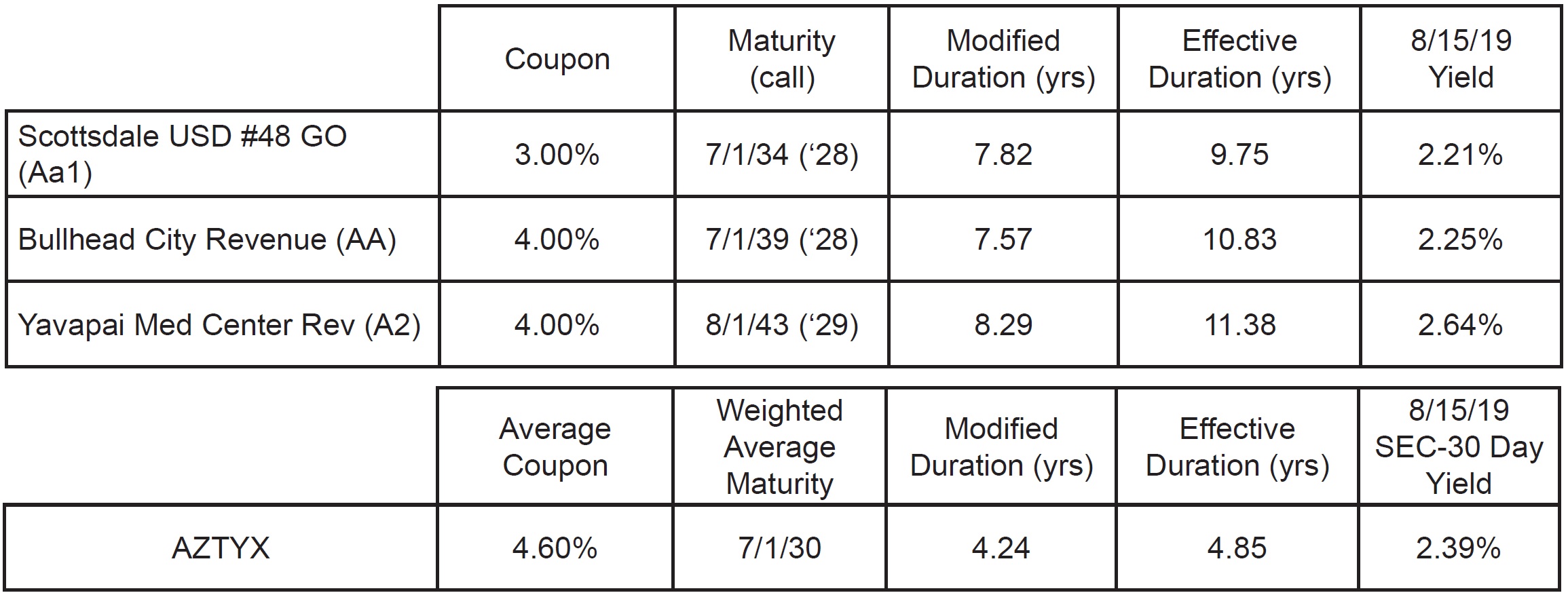

Let’s look at the other end of the spectrum. How much additional risk is there in a longer term bond with the same yield? First, you would have to find the same yield on a AA or higher rated muni in the current market. To obtain a yield above 2.50% in Arizona on a AA rated revenue or higher quality bond, an investor must either buy premium coupon bonds maturing 20 years or longer, or buy 3% coupon bonds near par that will mature in 15 years. Here are examples from recent new issues:

In the current market, this requires buying significantly longer maturity bonds that have almost twice the duration characteristics (and potentially interest rate risk / downside potential) of AZTYX. If market yields of individual bonds were to climb back to the levels that we saw eight months ago, the three bonds above would be expected to experience price declines of 10%-15%. Because of its much broader maturity and bond structure composition, the Net Asset Value (NAV) of Aquila Tax Free Trust of Arizona’s A Share, as of 8/15/19, was only 5.8% above the low of $10.28, last reached on November 7, 2018.

Click here to see the most recent quarter-end standardized performance

Performance data represents past performance, but does not guarantee future results. Investment return and principal value will fluctuate; shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the data presented.

Apples to Apples

These examples demonstrate both the importance and challenge of making an “apples to apples” comparison when evaluating the opportunities among individual municipal bonds vs. a municipal bond mutual fund. Another way to look at this is that it isn’t an opportunity if everyone sees it. Finding value is rarely a straightforward or obvious exercise. However, the sudden downdraft of municipal bond market yields the past 8 months has shined a bright light on the value proposition that genuinely diversified and thoughtfully managed mutual fund portfolios can deliver.

We believe that sustained tax-free income streams, combined with active risk management, are the attributes of a fixed income investment that create the greatest likelihood of success. Such success is often characterized by achieving positive, long term after-tax returns while limiting undue interest rate and credit risk. A best first step is to evaluate whether your investment opportunity has the ability to 1) attain a level of income that compensates for inflation after taxes and can maintain purchasing power, and may 2) mitigate a wide variety of risks (especially interest rate risk) at the same time. An actively managed mutual fund portfolio may deliver a better balance of yield and duration that achieves these investment objectives.

Please carefully read the Fund prospectus here. Before investing in one of the Aquila Group of Funds, carefully read about and consider the investment objectives, risks, charges, expenses, and other information found in the Fund prospectus. The prospectus is available on this site, from your financial advisor, or by calling 800-437-1020.

Mutual fund investing involves risk; loss of principal is possible. Investments in bonds may decline in value due to rising interest rates, a real or perceived decline in credit quality of the issuer, borrower, counterparty, or collateral, adverse tax or legislative changes, court decisions, market or economic conditions. Fund performance could be more volatile than that of funds with greater geographic diversification.

Modified and effective duration both measure the value of a security in response to a change in interest rates. Effective duration also takes into account the effect of embedded options.

The Bloomberg Barclays AAA GO Fair Value Index is representative of the universe of AAA general obligation bonds and reflects the fair value, which is halfway between the bid and offer price.

Independent rating services (such as Standard & Poor’s, Moody’s and Fitch) assign ratings, which generally range from AAA (highest) to D (lowest), to indicate the credit worthiness of the underlying bonds in the portfolio. Where the independent rating services differ in the rating they assign to an issue, or do not provide a rating for an issue, the highest available rating is used in calculating allocations by rating. Pre-refunded/Escrowed bonds are issued for the purpose of retiring or redeeming an outstanding bond issue at a specified call date. Until the call date, the proceeds from the bond issuance are typically placed in a trust and invested in US Treasury bonds or state and local government securities. Non-rated bonds are holdings that have not been rated by a nationally recognized statistical rating organization.

The 30-Day SEC yield is a mutual fund’s yield, calculated as required by the SEC, based on the earnings of the fund’s portfolio during a 30-day period, divided by the offering price per share at the end of the period. This calculation reflects an estimated yield to maturity. It should be regarded as an estimate of the fund’s rate of investment income, and it may not equal the fund’s actual income distribution rate.