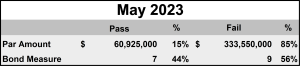

In unofficial election results, Oregon residents approved approximately $60 million of general obligation municipal bonds during the May 2023 Special Election to support local projects proposed by schools, cities and special districts throughout the State. Although results have yet to be certified, and therefore still deemed preliminary, the bonds approved by this election are in high demand, as investors seek high-quality, tax-exempt investment opportunities.

There are four scheduled election dates in Oregon each year: the second Tuesday in March, the third Tuesday in May, the third Tuesday in September, and the first Tuesday after the first Monday in November. In November 2008, Oregon voters approved Ballot Measure 56, which repealed a law requiring more than 50% of a county’s registered voters to vote in bond measure elections held in May and November. As a result, the May election has become an important election to follow for new bond measures.

Relative to recent elections, results from the May 2023 Special Election results were less supportive then they have been previously. By par amount, this is the most disappointing election we have seen in recent years, and pales in comparison to the $1.45 billion approved last November, or to the $838 million approved last May. Oregon typically sees more ballot measures during general elections, which are held in November of even-numbered years. Going back to 2017, this is the least successful bond measure election we have seen. By election measure, this election compares more closely with the May 2022 election, which approved 43% of measures, versus 44% in the current election. The difference with this election is that voters rejected every measure over $20 million.

Source: Aquila Investment Management LLC and various Oregon County Clerks

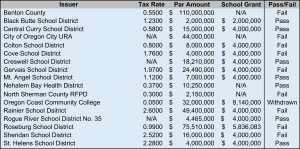

Key Bond Measures

The majority of the measures considered in this election were presented by school districts seeking funding for capital improvements. Of the 12 school districts on the ballot, half of them passed a bond measure. School districts use bond proceeds to support capital projects, such as constructing new schools, modernizing existing schools, or adding safety features. Almost all of the 12 school districts on the May ballot included renovation projects.

This is the second attempt for Roseburg School District and Gervais School District, both of which had measures previously defeated at the May 2022 election. Roseburg School District’s $75.5 million measure is about half of the $154 million requested at the May 2022 election. Although Roseburg’s 2023 measure includes many of the projects from the 2022 measure, the District did eliminate approximately $54 million in facility updates and new facilities, in addition to cutting back on outdoor athletic and community spaces. The average age of Roseburg’s schools is reportedly around 74 years. However, voters are currently rejecting the bond with double-digit margins.

A significant marketing point for several of the school issues has been the Oregon School Capital Improvement Matching (“OSCIM”) Program, which is a grant program offered by the Oregon Department of Education, supporting communities that pass general obligation municipal bonds for school improvements. In fact, all of the school districts on the May 2023 ballot included an OSCIM grant. An example from this election is St. Helens School District, which asked voters to approve a $4 million bond, which if approved, will be matched by an additional $4 million from the State. Measures such as this present a value to property taxpayers, since the District is essentially doubling the size of its project with the matching grant. The District’s measure is currently passing, with over 54% of votes in favor of the measure.

Source: Aquila Investment Management LLC and various Oregon County Clerks

Oregon Coast Community College District withdrew its $32 million ballot measure from the May ballot after discovering that its $8.14 million in matching funds from the Oregon School Capital Improvement Matching program had been reallocated. Since the matching funds were mentioned in the College’s ballot title and explanatory statement, and were a part of the discussion at its many public presentations, the College decided to reschedule the ballot measure. The College has issued a press release announcing it plans to present its bond measure at the May 2024 election.

The largest measure approved on this ballot was Creswell School District’s $18.21 million bond. The District plans to use bond proceeds to repair and update schools, improve safety and increase access to vocational skills training. The District has announced plans to appoint a citizen oversight committee to monitor the progress, schedule and costs of the bond. District voters were overwhelmingly in favor of the project, with preliminary results indicating close to 70% of votes in favor of the project and only 30% of votes against. In addition to the bond proceeds, the District will receive a $4 million grant from the OSCIM program.

Supply and Demand

Overall, this election will provide some much-needed supply to the bond market. However, in terms of par amount, or size, most of the issues will likely be too small for inclusion in the portfolio of Aquila Tax-Free Trust of Oregon. We anticipate that many of the failed measures will likely be shelved until they can be presented to voters again at a future election.

Will the amount of new issues be enough to affect supply/demand dynamics? Although approximately $134 billion in municipal bond principal will be maturing nationally over the coming months, new issuance is down more than 20% year-over-year, according to The Bond Buyer. While Oregon’s Special Election will help alleviate some of the supply concerns, we expect that sourcing bonds in the new issue market may continue to be a challenge. The Fund’s locally-based investment team will continue to search for opportunities to help meet its stated objectives for shareholders.

The information is general in nature and is not intended to provide investment, accounting, tax or legal advice. It is not intended to represent a recommendation or solicitation related to any particular investment, security or industry sector. The opinions shared are those of the author and do not necessarily reflect those of the Investment Adviser of the Fund.

Mutual fund investing involves risk; loss of principal is possible. Investments in bonds may decline in value due to rising interest rates, a real or perceived decline in credit quality of the issuer, borrower, counterparty, or collateral, adverse tax or legislative changes, court decisions, market or economic conditions. State-specific fund performance could be more volatile than that of funds with greater geographic diversification.

Before investing in the Fund, carefully read about and consider the investment objectives, risks, charges, expenses and other information found in the Fund prospectus. The prospectus is available from your financial professional, by clicking here, or by calling 800-437-1020.