Preliminary results from the November 2022 Colorado general election were a mixed bag for the State. Voters approved multiple statewide ballot measures, including:

- Proposition FF – to provide healthy meals for public school students

- Proposition 121 – to reduce the state income tax rate to 4.40% from 4.55%

- Proposition 123 – for affordable housing programs

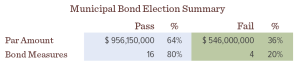

Although results have yet to be certified and are therefore deemed preliminary, nearly $1.0 billion of general obligation bonds were approved by Colorado voters. While this election was considered a success for local governments, when compared with the November 2021 election, which approved $1.2 billion of issuance, this election fell a bit short. By election measure, approximately 80% of issues were approved, which represents 64% of the total requested par amount (see below).

Source: Kirkpatrick Pettis Capital Management and Colorado Secretary of State

Source: Kirkpatrick Pettis Capital Management and Colorado Secretary of State

Key Bond Measures

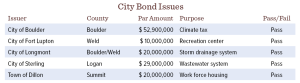

There were more than 150 municipal ballot measures voted upon in Colorado. Ballot measures covered a wide range of purposes, including: housing, broadband, bond proposals for public improvements, governance, homelessness, marijuana, tax increases, property tax rate adjustments, election changes, and charter amendments. Two property tax mill levy increases passed, and two mill levy increases failed by voters, in addition to $131.9 million of city bond issues.

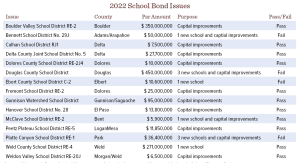

Colorado voters were faced with $1.4 billion of school bond issues in 15 school district elections, compared to the $1.5 billion school districts requested from voters in 2021. School district bond issues on the ballot ranged from $5.9 million to $450 million. Voters approved 11 of the 15 school district bond issues for $824.2 million that will fund new schools and capital improvements. In addition, voters also approved $36.7 million in school district mill levy overrides. Historically, Colorado voters have shown a willingness to approve the majority of local bond measures, the success of school bond issues this year were lower than in most past years.

Source: Kirkpatrick Pettis Capital Management and Colorado Secretary of State

Source: Kirkpatrick Pettis Capital Management and Colorado Secretary of State

Source: Kirkpatrick Pettis Capital Management and Colorado Secretary of State

Source: Kirkpatrick Pettis Capital Management and Colorado Secretary of State

Potential Increase in Supply

Overall, voters continue to demonstrate a willingness to approve local bond measures, which provide new schools and other capital improvements throughout the State. Upon final approval, this election should provide a much-needed source of additional supply to the municipal bond market.

The information is general in nature and is not intended to provide investment, accounting, tax or legal advice. It is not intended to represent a recommendation or solicitation related to any particular investment, security or industry sector. The opinions shared are those of the author and do not necessarily reflect those of the Investment Adviser of the Fund.

Mutual fund investing involves risk; loss of principal is possible. Investments in bonds may decline in value due to rising interest rates, a real or perceived decline in credit quality of the issuer, borrower, counterparty, or collateral, adverse tax or legislative changes, court decisions, market or economic conditions. State-specific fund performance could be more volatile than that of funds with greater geographic diversification.

Before investing in the Fund, carefully read about and consider the investment objectives, risks, charges, expenses and other information found in the Fund prospectus. The prospectus is available from your financial professional, by clicking here, or by calling 800-437-1020.