In unofficial election results, Oregon residents approved approximately $782 million of general obligation municipal bonds to support local projects proposed by schools, cities and special districts throughout the State during Oregon’s May 2024 Primary Election. Although results have yet to be certified and therefore still preliminary, the bonds approved by this election are generally considered to be in high demand, as investors seek high-quality tax-exempt investment opportunities.

As background, there are four scheduled election dates in Oregon each year: the second Tuesday in March, the third Tuesday in May, the third Tuesday in September, and the first Tuesday after the first Monday in November. In November 2008, Oregon voters approved Ballot Measure 56, which repealed a law requiring more than 50% of a county’s registered voters to vote in bond measure elections held in May and November. As a result, the May election has become an important election to follow for new bond measures.

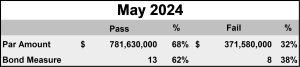

Preliminary Summary of Results

Relative to recent elections, results from the May 2024 Primary Election were more supportive then they have been. By par amount, this is the strongest election we have seen since $1.45 billion was approved at the November 2022 election. Oregon typically sees more ballot measures during general elections, which are held in November of even-numbered years.

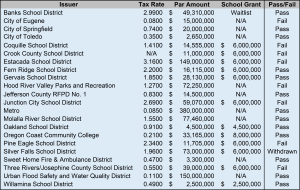

The majority of the measures considered in this election were presented by school districts seeking funding for capital improvements. School districts typically use bond proceeds to support capital projects, such as constructing new schools, modernizing existing schools, or adding safety features. A significant marketing point for several of the school issues has been the Oregon School Capital Improvement Matching (OSCIM) Program, which is a grant program offered by the Oregon Department of Education, supporting communities that pass general obligation bonds for school improvements. An example from this election is Oakland School District, which asked voters to approve a $4.5 million bond. If approved, the issue will be matched by an additional $4.5 million from the State. Measures such as this present a value to property taxpayers, since the District is doubling the size of its project with the matching grant. The District’s measure is currently narrowly passing, with approximately 50.3% of votes in favor of the measure.

The largest measure approved on this ballot was Metro’s $380 million bond for improvements to the Oregon Zoo. Metro plans to use bond proceeds to update aging exhibits with more natural, modern habitats, including: penguins, sea otters, and giraffes. Additional improvements are planned for conserving water and energy in zoo operations and updating infrastructure.

Looking Ahead

Once again, the results of Oregon’s May 2024 Primary Election have yet to be certified and therefore still preliminary. Overall, preliminary results indicate this election can generally be considered a success for Oregon local governments, with a number of important projects approved throughout the State.

The locally-based investment team for Aquila Tax-Free Trust of Oregon will closely monitor these bond measures, along with all investment opportunities, as part of its active management strategy to help meet the investment objectives of the Fund and its shareholders.

This information is general in nature and is not intended to provide investment, accounting, tax or legal advice, nor is it intended to represent a recommendation or solicitation related to any particular investment, security or industry sector. The opinions shared are those of the author and do not necessarily reflect those of the Investment Adviser of the Fund.

Mutual fund investing involves risk; loss of principal is possible. Investments in bonds may decline in value due to rising interest rates, a real or perceived decline in credit quality of the issuer, borrower, counterparty, or collateral, adverse tax or legislative changes, court decisions, market or economic conditions. State-specific fund performance could be more volatile than that of funds with greater geographic diversification.

Before investing in the Fund, carefully read about and consider the investment objectives, risks, charges, expenses and other information found in the Fund’s prospectus. The prospectus is available from your financial professional, by clicking here, or by calling 800-437-1020.