As the economy continues to recover from the pandemic-driven recession, focus has turned to the resulting change in the Federal Reserve’s policy. The facts are undeniable as we review current economic conditions (see Exhibit 1 below). A tremendous part of the recovery could be attributable to the early and decisive action taken by Federal Reserve Chairman Jerome Powell. Since early 2020, the Federal Reserve (the “Fed”) has maintained the Federal Funds rate (the target interest rate at which commercial banks borrow and lend their excess reserves to one another overnight) near zero and expanded its balance sheet by trillions of dollars through their monthly purchases of U.S. Treasury bonds and mortgage-backed securities (“MBS”). As of early-March 2022, the Fed held almost $6 trillion in Treasuries and over $2.5 trillion in MBS — remarkable amounts on an historical basis.

Exhibit 1 – Economic Data as of 3/5/22

Domestic and Global Economic Factors

With inflation running well above the Fed’s goal of 2%, the economy approaching what some economists would consider “full employment,” a Fed Funds rate near zero, and monthly asset purchases still being executed, it appears that time for a substantial policy change is appropriate. Most market pundits expected the Federal Reserve to initiate an interest rate increase of 25 basis points at its March Federal Open Market Committee (“FOMC”) meeting. At one point, the market had built in a high probability of an initial 50 basis points increase. However, the uncertainty surrounding the Russia-Ukraine conflict and its spillover effects on economic growth tempered expectations of an aggressive first hike. Yet, following the March meeting, Mr. Powell’s comments indicated that the Fed would be very flexible in its policy and could certainly consider a more aggressive move at future meetings, if warranted.

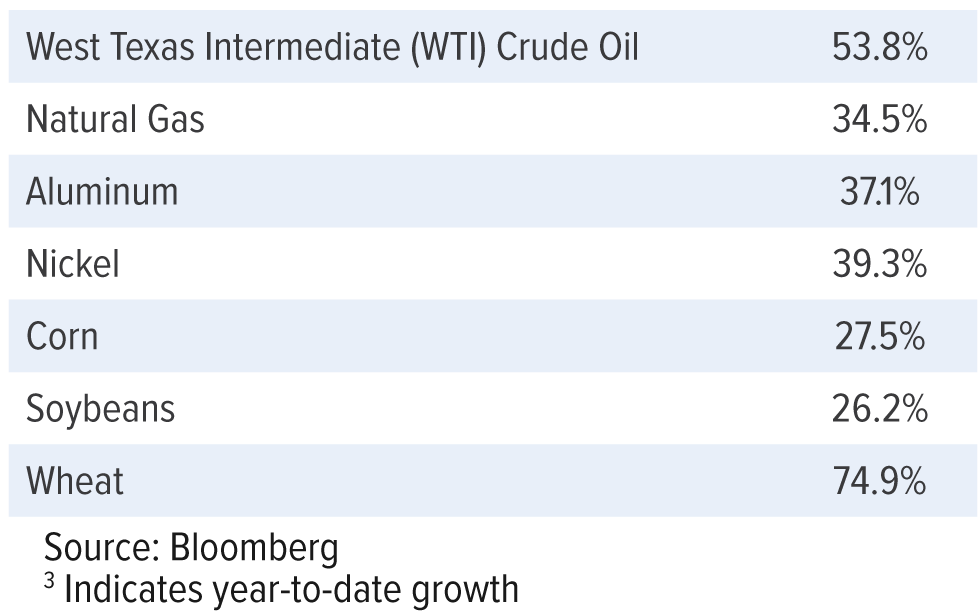

As the conflict in Eastern Europe continues to escalate, we have seen an historic rise in many commodity prices (see Exhibit 2 below). Some of these moves have likely been driven by the strong economic rebound experienced in the U.S., driving demand for many products, while supply chain disruptions limit production and delivery of goods. However, since Russia invaded Ukraine, we have seen a dramatic increase in prices of commodities such as oil, natural gas, and wheat due to recent sanctions (both imposed and voluntary).

Exhibit 2 – Commodity Price Changes as of 3/5/22 3

A Balancing Act

The Federal Reserve is in a very difficult position, as U.S. economic data continues to point toward strong growth, improved employment, and elevated inflation, while prospects of some global economic weakness abroad from the European conflict could have effects domestically as well. Aside from the precarious factors the Fed needs to consider in terms of potential rate hikes in the coming months, it must also determine how to address its enormous balance sheet. Recall back in 2018, just prior to the COVID-19 pandemic, the Fed was slowly reducing its $4.2 billion balance sheet, which had been elevated due to the Great Financial Crisis (“GFC”) of 2008. With hopes of returning the balance sheet to pre-GFC levels (approximately $1 billion), the Fed barely made measurable progress before the pandemic hit (see Exhibit 3 below).

Exhibit 3 – Federal Reserve Balance Sheet

“Soft Landing” or Another “Conundrum?”

It remains to be seen if Mr. Powell can pull off a “soft landing,” by raising rates, reducing the balance sheet, and getting inflation back to more normal levels. With the Consumer Price Index (“CPI”) at a multi-decade high of 7.5%, real interest rates (yield, minus CPI) remain very negative. Yet, it could take many months to get real rates into positive territory, especially if the recent rise in commodity prices does not reverse in the coming months. You may remember that during the 2004-2006 tightening cycle, where the Fed Funds rate moved from 1% to 5.25%, economic growth was churning along at a healthy 4-5%. The U.S. is experiencing similar economic growth today and much higher inflation. Yet, it may be hard to imagine the economy in the foreseeable future being able to support growth rates as high as 5%. Additional tools have, however, become available to the Fed since 2004, and it appears likely that a more aggressive balance sheet reduction could help get inflation back in check while keeping interest rates at a more tenable level.

During the tightening in 2004-2006, then-Fed Chairman Alan Greenspan famously said the move in U.S. Treasury yields was a “conundrum,” as 10-year Treasury yields failed to rise even though short-term rates were ratcheting higher. We may be approaching an era of the next Federal Reserve conundrum, as yields on the short-end of the curve are expected to track movement in the Fed Funds rate, yet longer-dated U.S. Treasuries may remain range-bound in anticipation of slower economic growth and (hopefully) lower inflation.

Considerations for Investors

Fixed income investors who may be anticipating—or in some cases hoping for—a precipitous, steady march towards higher yield levels, may be in store for a letdown. And those bondholders who are delaying investments until the arrival of that presumed higher interest rate environment may risk missing out on opportunities to generate income from their portfolio. Hence, it may be prudent to remain involved in the fixed income markets yet consider a more conservative interest rate risk profile. Generally speaking, during rising interest rate cycles, bonds with shorter maturity and duration tend to experience lower price fluctuation compared with longer-term bonds. But, of course, be sure to invest according to your individual financial goals and risk tolerances.

At Aquila Group of Funds, we believe it is important to not let your emotions overtake your investment plan, especially during periods of uncertainty. A common mistake that investors make is to allow fear or uncertainty keep them from participating in financial opportunities, rather than sticking with their intended plans. We therefore believe it is important to try to remain focused on your individual financial goals, your time frame for achieving them, and your tolerance for risk. Now may be an opportune time to speak with a financial professional to review your investment portfolio to determine whether it aligns with your individual goals.

This is for informational purposes only and not intended to represent a solicitation to buy or sell any particular security.

Mutual fund investing involves risk; loss of principal is possible. Investments in bonds may decline in value due to rising interest rates, a real or perceived decline in credit quality of the issuer, borrower, counterparty, or collateral, adverse tax or legislative changes, court decisions, market or economic conditions.

Before investing in any fund offered by Aquila Group of Funds, carefully read about and consider the investment objectives, risks, charges, expenses, and other information found in the Fund’s prospectus. The prospectus is available from your financial professional, by clicking here or calling 800-437-1020.