The COVID-19 pandemic has caused the learning environment in Colorado’s higher education institutions to change dramatically. Students were forced to end the spring 2020 semester learning virtually, and Colorado universities plan on opening the fall 2020 semester learning on campus along with a hybrid approach of on campus and virtual learning.

According to Standard & Poor’s (S&P), “the COVID-19 pandemic and related economic and financial impacts exacerbate pressures already facing colleges and universities.” S&P’s ratings outlook has been negative for three straight years in the U.S. not-for-profit higher education sector. Moody’s lowered its rating outlook to negative for the higher education sector on March 18, 2020 due to “unprecedented enrollment uncertainty.”

To balance Colorado’s $3 billion revenue shortfall for its fiscal year 2020-21 budget, the state cut its support to the Department of Higher Education’s fiscal year 2020-21 budget by $493 million. However, the governor allocated $450 million from the Coronavirus Aid, Relief and Economic Stimulus Act (CARES) to the state’s public colleges and universities to help minimize the budget cuts.

Enrollment increased at most of Colorado’s universities in fiscal year 2020, but COVID-19 continues to present uncertainty for the fall semester. A resurgence of COVID-19 could reduce future enrollment at Colorado universities and impact revenues, as expenses increase due to a shift to an online learning environment. Currently, none of Colorado’s public universities have plans to raise tuition for fiscal year 2021.

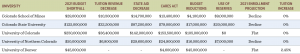

Every institution of public higher education in Colorado was affected by the reduction in state funding. Public higher education institutions have instituted furloughs, hiring freezes, layoffs and other cost cutting strategies The one-time CARES support will soften the blow for fiscal year 2021, but fiscal year 2022 could be challenging if enrollments decline and state aid is further reduced. Currently, there are no plans for additional federal support to higher education institutions. The chart below demonstrates the current Fund holdings of higher education bonds and the amount of state aid reduction and CARES support received.

Higher education institutions represented 16% of Aquila Tax-Free Fund of Colorado’s portfolio as of June 30, 2020. Of this amount, almost 75% of the higher education bonds are insured, pre-refunded or part of the state’s intercept program, which makes debt service payments if the public higher education institution is unable. We will continue to monitor the Fund’s higher education portfolio holdings and their ability to withstand any potential uncertainty with a resurgence of COVID-19 and any future state aid reductions.

Before investing in a Fund, carefully read about and consider the investment objectives, risks, charges, expenses, and other information found in the Fund prospectus. All prospectuses are available on this site, from your financial advisor, and when you call 800-437-1020.

Information regarding holdings is subject to change and is not necessarily representative of the entire portfolio.

Mutual fund investing involves risk; loss of principal is possible. Investments in bonds may decline in value due to rising interest rates, a real or perceived decline in credit quality of the issuer, borrower, counterparty, or collateral, adverse tax or legislative changes, court decisions, market or economic conditions. Fund performance could be more volatile than that of funds with greater geographic diversification.