While the current tax reform proposal by the White House lacks details, the outline released does include several items meaningful to the individual tax payer:

- Reduction of the current seven tax brackets to three: 10%, 25% and 35%. However, the proposal does not indicate the levels of income for each bracket.

- Deductions would change: the standard deduction would be nearly doubled to $24,000. Itemized deductions would be capped at $100,000 for single filers and $200,000 for married couples filing jointly. Tax breaks for charitable giving, mortgage interest and retirement savings would remain, however, the administration would like to eliminate the deduction for state and local taxes (SALT), which is one of the largest federal tax expenditures.

- The administration would also like to end the Alternative Minimum Tax (AMT) and eliminate the 3.8% Net Income Investment Tax (NIIT) which applies to investment income of taxpayers with a modified adjust gross income (MAGI) of more than $200,000 for single filers and $250,000 for married couples filing jointly. This would bring the capital gains rate down for high earners from 23.8% to 20%.

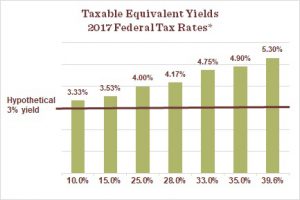

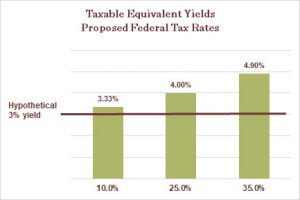

The proposal is still in its initial stages and will likely have many changes prior to enactment. There are questions as to whether the proposal could influence the municipal bond market and the value of tax-free investing. The following charts display the current federal tax brackets and the initially proposed tax brackets using a hypothetical taxable investment yielding 3% to illustrate Taxable Equivalent Yields.

The benefit of tax-exempt income remains, even at the proposed tax rates, although it is reduced slightly by the lower tax brackets. Tax-exempt income continues to provide a significant incentive to consider municipal bonds as an alternative to taxable income investments, particularly for the higher income taxpayer.

*Current taxable equivalent yields are based on 2017 federal tax rates and do not include the 3.8% NIIT where applicable.

These are hypothetical illustrations and do not represent an actual investment, interest rate or return on any investment.