Preliminary results from the November 2023 Colorado general election were a mixed bag for the State. There were more than 120 municipal ballot measures in this year’s election. Ballot measures covered housing, governance, marijuana, election changes, tax increases, revenue retention, election changes and charter amendments. Of note, voters approved Proposition II, a Tobacco and Nicotine Product Tax Revenue Measure, which would retain nicotine tax revenue in excess of estimates. Meanwhile, voters rejected Proposition HH, a Property Tax Changes and Revenue Change Measure, intended to reduce property taxes and retain state revenue on the statewide ballot.

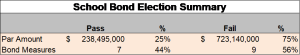

Although results have yet to be certified, and are still considered preliminary, nearly $240.0 million of general obligation bonds were approved by Colorado voters. This election may be viewed as disappointing for school districts, particularly when compared with the November 2022 election, which approved $824.2 million of issuance. Below is an overall school bond summary:

Key Bond Measures

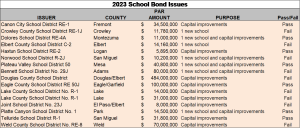

Colorado voters were faced with $961.6 million of school bond issues in 16 school district elections, compared to the $1.4 billion school districts requested from voters in 2022. School district bond issues on the ballot ranged from $5.9 million to $484 million. Voters approved 7 of the 16 school district bond issues for a total of $238.5 million that will fund new schools and capital improvements. In addition, voters also approved $72.7 million in school district mill levy overrides. Historically, Colorado voters have shown a willingness to approve the majority of local bond measures. The success of school bond issues this year were lower than in most past years. Below is a list of individual school bond issue results:

Potential Boost to New Issue Supply

Overall, voters appeared reluctant to approve local bond measures, which were intended provide new schools and other capital improvements throughout the State. The results of these elections would provide added supply to the municipal market, as bonds related to these measures are expected to be sold later this year and into 2024.

The locally-based investment team for Aquila Tax-Free Fund of Colorado will closely monitor these bond measures, along with all investment opportunities, as part of its active management strategy to help meet the investment objectives of the Fund and its shareholders.

This information is general in nature and is not intended to provide investment, accounting, tax or legal advice, nor is it intended to represent a recommendation or solicitation related to any particular investment, security or industry sector. The opinions shared are those of the author and do not necessarily reflect those of the Investment Adviser of the Fund.

Mutual fund investing involves risk; loss of principal is possible. Investments in bonds may decline in value due to rising interest rates, a real or perceived decline in credit quality of the issuer, borrower, counterparty, or collateral, adverse tax or legislative changes, court decisions, market or economic conditions. State-specific fund performance could be more volatile than that of funds with greater geographic diversification.

Before investing in the Fund, carefully read about and consider the investment objectives, risks, charges, expenses and other information found in the Fund’s prospectus. The prospectus is available from your financial professional, by clicking here, or by calling 800-437-1020.