Preliminary results indicate Oregon residents have approved $19 million in new bond measures across the State at the November special election, which is considered very weak compared to previous elections. For instance, last November, voters approved a more typical amount of $1.45 billion in new bond measures. Although election results have yet to be certified, and are therefore still considered preliminary, we are unlikely to see any additional bonds pass during this election.

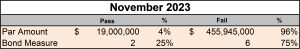

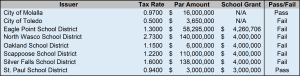

Oregon typically sees more ballot measures during general elections, which are held in November of even-numbered years. By election measure, only 25% of the issues presented were approved. And relative to the requested par amount, a paltry 4% was approved by voters. In addition to low approval rates, the voter turnout was relatively low, with only 31.31% of active registered voters in the State casting a ballot. Below is an overall summary of this year’s local bond measures:

Every Vote Counts

The City of Molalla’s general obligation bond measure referenced above is a good example of every vote counting. The latest election results indicate the measure is narrowly passing, with 927 “yes” votes and 922 “no” votes. The City is requesting voters approve $16 million in general obligation bonds to finance a new police facility on the site of the old Molalla Bowl property. The bond would run for 26 years with an annual tax rate of $0.97 per $1,000 of assessed value, or an estimated $20.21 per month for a home assessed at $250,000. Currently, the City’s police department does not have a protected garage or space for on-site training, and lacks a secure temporary holding facility, which is a safety concerns when dealing with violent offenders.

The Clackamas County Elections Clerk has an automatic mechanism in place that triggers a recount automatically if the vote is within one-fifth of one percent. The final official certified tally will be determined on December 4, 2023 at 2:00 p.m. local time.

New Bond Issuance and Supply

Oregon deal flow has been relatively robust for 2023 versus last year, with tax-exempt non-AMT (Alternative Minimum Tax) new bond issuance through the end of October ($3.74 billion) exceeding issuance for all of 2022 ($2.16 billion) by over 70%. Over this past year, Oregon municipal bond issuance has primarily come from the State, Portland Public Schools and the City of Portland. However, issuance in recent months has been exceptionally low, without a single new issue in Oregon for the entire month of October, and only four new issues in September. Furthermore, new issues have been multiple times oversubscribed with strong national institutional demand. Overall, this election does not provide much confidence for additional supply going into 2024.

The locally-based investment team for Aquila Tax-Free Trust of Oregon will closely monitor these bond measures, along with all investment opportunities, as part of its active management strategy to help meet the investment objectives of the Fund and its shareholders.

This information is general in nature and is not intended to provide investment, accounting, tax or legal advice, nor is it intended to represent a recommendation or solicitation related to any particular investment, security or industry sector. The opinions shared are those of the author and do not necessarily reflect those of the Investment Adviser of the Fund.

Mutual fund investing involves risk; loss of principal is possible. Investments in bonds may decline in value due to rising interest rates, a real or perceived decline in credit quality of the issuer, borrower, counterparty, or collateral, adverse tax or legislative changes, court decisions, market or economic conditions. State-specific fund performance could be more volatile than that of funds with greater geographic diversification.

Before investing in the Fund, carefully read about and consider the investment objectives, risks, charges, expenses and other information found in the Fund’s prospectus. The prospectus is available from your financial professional, by clicking here, or by calling 800-437-1020.