This February, Aquila Group of Funds celebrated the 35th Anniversary of Hawaiian Tax-Free Trust, the company’s flagship municipal bond fund. Aquila’s founder, the late Lacy Herrmann, was one of the earliest creators of single-state, tax-free municipal bond funds. He recognized the need for double tax-free income in states with high income tax rates, and brought a new perspective to the asset class with a focus on local involvement.

This February, Aquila Group of Funds celebrated the 35th Anniversary of Hawaiian Tax-Free Trust, the company’s flagship municipal bond fund. Aquila’s founder, the late Lacy Herrmann, was one of the earliest creators of single-state, tax-free municipal bond funds. He recognized the need for double tax-free income in states with high income tax rates, and brought a new perspective to the asset class with a focus on local involvement.

In 1985 Mr. Herrmann led Aquila in partnering with Hawaiian Trust Company (acquired by the current Trust Advisor, Bank of Hawaii) to secure, and hire a local Portfolio Management team to oversee the Trust’s portfolio of investments given their deep knowledge of Hawaii municipal issuers and close proximity to the projects which shareholders’ money would finance. He also carefully selected a Board of Trustees to govern the Trust which included local Hawaii professionals from various business backgrounds, representing Hawaii’s diverse population.

Sherri Foster, a resident of Maui, joined the Aquila team prior to the Trust’s launch to work with local Financial Professionals and Shareholders. She was interviewed in the article Island Hopping, and continues to represent Aquila Group of Funds and Hawaiian Tax-Free Trust today.

When asked about the time in her role, Sherri said:

“I am proud to represent the first and largest Hawaii municipal bond fund, “HTFT”, as a shareholder and Regional Sales Manager since the opening day on February 20, 1985. My role working with financial institutions across our state has given me the opportunity to build many relationships and make friends with financial professionals and shareholders alike. I love my job, and say Mahalo to everyone who has supported us for the past 35 years.”

“I am proud to represent the first and largest Hawaii municipal bond fund, “HTFT”, as a shareholder and Regional Sales Manager since the opening day on February 20, 1985. My role working with financial institutions across our state has given me the opportunity to build many relationships and make friends with financial professionals and shareholders alike. I love my job, and say Mahalo to everyone who has supported us for the past 35 years.”

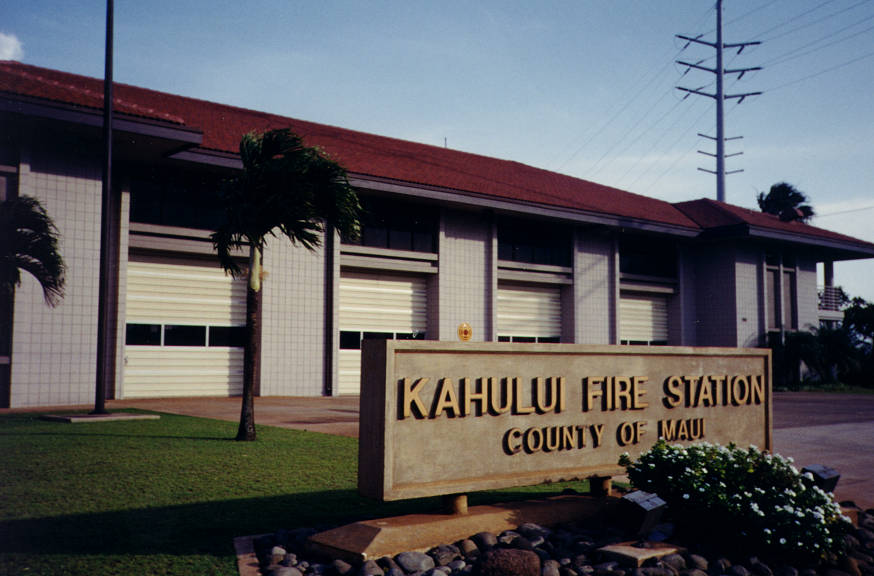

If you’ve passed by the Kahului Fire Station on Maui, visited the Kona Community Aquatic Center on the Big Island or driven on the H-3 Freeway on Oahu, you’ve seen some of the many projects that Hawaiian Tax-Free Trust shareholders have helped build over the years. The Trust has financed highways, hospitals, bridges, airports, water treatment facilities, convention centers and many other projects across the islands, while providing investors the highest possible level of income exempt from Hawaii state and federal income taxes, consistent with preservation of capital.

Following the launch of Hawaiian Tax-Free Trust, Aquila launched six additional single-state municipal bond funds between 1986 and 1992; all of which still serve shareholders in Arizona, Colorado, Kentucky, Oregon, Rhode Island and Utah. Today, Aquila’s mutual fund line-up consists of nine funds, including a high-yield corporate bond fund and an equity fund, but the company’s reputation for exceptional customer service, and conservative asset management, is rooted in the disciplined investment approach of managing locally based municipal portfolios through various market cycles for over three decades.

You can learn more about Aquila’s disciplined management approach and our commitment to the shareholders and financial professionals we serve by reading our company brochure, A Careful Approach for Today’s Markets, and our Guiding Principles on this website.

In addition to the many Financial Professionals and Shareholders who have supported the Trust over the past 35 years, Aquila Group of Funds would like to recognize various Trustees, Portfolio Managers and others who have made Hawaiian Tax-Free Trust a success:

Vernon R. Alden, William J. Barton, Arthur K. Carlson, William M. Cole, Thomas W. Courtney, Robert Crowell, Sherri Foster, Richard W. Gushman II, Diana P. Herrmann, Lacy B. Herrmann, Stanley W. Hong, Richard L. Humphreys, Janet Katakura, B.J. Kobayashi, Yvonne Lim Warren, Catherine Luke, Denis Massey, Tobias M. Martyn, Theodore T. Mason, Stephanie C. Nomura, Glenn P. O’Flaherty, Russell K. Okata, Lorene L. Okimoto, Richard T. O’Reilly, Randy P. Perreira, Douglas Philpotts, Stephen K. Rodgers, Peter E. Russell, Reid Smith, Oswald K. Stender and Thelma Chun-Hoon Zen

Mutual fund investing involves risk; loss of principal is possible. Investments in bonds may decline in value due to rising interest rates, a real or perceived decline in credit quality of the issuer, borrower, counterparty, or collateral, adverse tax or legislative changes, court decisions, market or economic conditions. Fund performance could be more volatile than that of funds with greater geographic diversification.

The Trust seeks to provide as high a level of income exempt from state and federal income tax as is consistent with capital preservation. For certain investors, some dividends may be subject to federal and state income taxes, including the Alternative Minimum Tax (AMT). Please consult your professional tax advisor.

Before investing in a Fund, carefully read about and consider the investment objectives, risks, charges, expenses, and other information found in the Fund prospectus. The prospectus is available on this site, from your financial professional and when you call 800-437-1020.