How an Active Fixed Income Strategy May Help Mitigate Reinvestment Risk

More than two years and over 500 basis points later, the Federal Reserve (the “Fed”) has executed one of its most aggressive monetary policy moves in decades, bringing the Federal Funds rate (the rate that banks charge each other to borrow or lend excess reserves overnight) to a current target range of 5.25%-5.5%. Although the Fed elected to keep rates unchanged during the September Federal Open Market Committee meeting, it has hinted at maintaining a “higher for longer” stance. With recent economic data remaining resilient, including an historically strong labor market, is the possibility that interest rate hikes may resume before the end of 2023.

The end result is an interest rate environment that most investors have not experienced in many years, if at all, in their lifetimes, and has been widely viewed as a potential end of the 40-plus-year bond bull market. Performance over this period in the fixed income markets has been challenging, as seen by the Bloomberg U.S. Aggregate Index and Bloomberg U.S. Treasury Index both falling over 10% since the Fed began raising rates in March 2022. However, we believe this has left investors with an opportunity to potentially earn attractive returns now that yields have risen to a level not seen in almost 20 years.

Risk Versus Reward

With a reasonable estimated long-term return assumption of 6%-7% for U.S. equities from a long-term historical perspective, many investors are considering the plethora of opportunities in the fixed income markets that could potentially rival that performance, while at the same time, seeking to mitigate the risk of loss to their investment principal.

For instance, many investors have recently increased their asset allocation to fixed income through what is generally viewed as the safest and most liquid market, U.S. Treasury Bills. Who could blame them? The yields on 6-month Treasury Bills have risen as high as 5.5% in annualized yield to maturity, while offering investors what has historically been known as the “risk-free rate of return.” By comparison, intermediate maturity investment-grade corporate bonds are currently yielding approximately 6%, and high-yield corporate bonds offer yields in the range of 8.5%-9%. So, on the risk/reward spectrum, investors have an interesting set of options. They also need to consider the different characteristics of various fixed income asset classes, and which are best suited for their individual investment needs and tolerance for risk.

As we think about the inherent risks of fixed income investing, primarily credit and interest rate risk, let’s take a closer look. Risk of default (credit risk) for U.S. Treasury Bills is generally considered to be non-existent (especially over a short holding period), while loss of principal from rising rates, as measured by duration (interest rate risk), is similarly remote. However, this brings us to a risk that has not been widely considered by fixed income investors for many years and perhaps even forgotten: reinvestment risk.

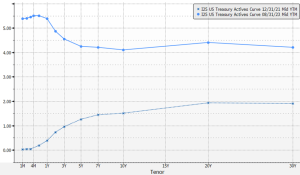

In a “normal” interest rate environment, the yield curve would be positively sloped (see Exhibit 1 – Yield Curve Dated 12/31/21) to compensate investors for the risk of inflation eating away at their rate of return, as well as the longer-term risk of default. However, in the current interest rate environment, short-term rates are substantially higher than long term rates (see Exhibit 1 – Yield Curve Dated 8/31/23), creating what is known as a yield curve “inversion.” This inversion, likely the result of the Fed’s aggressive monetary policy, as well as investors’ increased appetite for longer-dated Treasury Notes and Bonds to protect against a potential recessionary environment, has created an interesting conundrum. Compelling yields in the front end of the curve now appear to be a very attractive option for investors, as they expect to earn more income by investing in short-term investments compared to longer-dated issues.

However, the reinvestment risk mentioned earlier now comes to the forefront. This lurking risk, unbeknownst to many investors, relates to the “risk” of rates being lower when these short-term investments mature. Although earning approximately 5.5% on an annualized basis for this “risk-free” option, investors might need to consider the future interest rate environment when bonds come due, since that yield may not be available to reinvest maturity proceeds if rates begin to decline. Hence, the possibility, or risk, of earning less income in the future due to a declining rate environment.

EXHIBIT 1 – U.S. Treasury Yield Curve (12/31/21 and 8/31/23)

So, how do investors navigate the fixed income markets to take advantage of the current rate environment, while potentially mitigating the various associated risks, including reinvestment risk? Credit risk is generally mitigated by in-depth fundamental analysis of an issuer’s credit metrics, while interest rate risk can be monitored by keeping portfolio duration within an investor’s risk profile based upon their individual investment goals and objectives.

As the fixed income markets move toward the possibility of rates remaining range-bound and eventually declining, reinvestment may become a more important risk factor to consider. Yet this risk creates some challenges, especially with the compelling opportunities to earn more income in short maturity investments compared to more interest-rate sensitive, longer duration assets. Thus, many investors may become complacent and not give it much thought. However, once the risk materializes in a rapidly declining rate environment, it may become too late to adequately react. Therefore, fixed income investors should prepare sooner rather than later by creating a well-diversified portfolio that balances various maturities across the yield curve.

At current interest rate levels, short maturity positions offer investors a relatively attractive rate of return if held through maturity, while intermediate and long-term maturities may lock in historically high yields for an extended period of time. In addition, as interest rates eventually decline, the reinvestment risk realized by putting short maturity proceeds back into the market at lower yields could be offset by the appreciating prices of an investor’s longer-term positions. As a reminder, bond prices move inversely to rates/yields, meaning that bond prices generally increase as yields decline.

The Role of Active Portfolio Management

The description of the various risk factors referenced above, which include credit risk, interest rate risk and reinvestment risk (to name a few), and the inherently volatile fixed income markets, may make for an overwhelming task for individuals who may hope to enjoy the long-term benefits of a well-diversified bond portfolio. Therefore, investors may wish to consider an active portfolio management approach and the role it plays in helping to mitigate the various risk factors, while seeking high current income and the potential for attractive risk-adjusted returns.

Considerations for Investors

Generally speaking, during rising interest rate cycles, bonds with shorter maturity and duration tend to experience lower price fluctuation compared with longer-term bonds. If interest rates continue to rise and overall financial conditions become more challenging, high-yield investing—particularly through active portfolio management, using in-depth credit analysis and well-constructed duration strategies—may help investors avoid potential “land mines,” while generating attractive, high current income. Of course, past performance cannot be a predictor for the future, and investors should be sure to understand and evaluate the financial markets and related conditions before making any investment decisions.

At Aquila Group of Funds, we believe it is important to not let your emotions overtake your investment plan, especially during periods of uncertainty. A common mistake that investors make is to allow fear or uncertainty keep them from participating in financial opportunities, rather than sticking with their intended plans. Rather, try to remain focused on your individual financial goals, your time frame for achieving them, and your tolerance for risk. Now may be an opportune time to speak with a financial professional to review your investment portfolio to ensure it aligns with your individual goals.

This information is general in nature and is not intended to provide investment, accounting, tax or legal advice, nor is it intended to represent a recommendation or solicitation related to any particular investment, security or industry sector. The opinions shared are those of the portfolio manager and do not necessarily reflect those of the Investment Adviser of the Fund.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index considered representative of the universe of fixed-rate, investment grade taxable debt. The Bloomberg U.S. Corporate High Yield Index is an unmanaged index considered representative of the universe of fixed-rate, noninvestment grade debt. Performance of an index does not reflect management fees and expenses which are reflected in Fund performance. An investment cannot be made directly in an index. Past performance does not guarantee future results.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy of completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith.

Mutual fund investing involves risk; loss of principal is possible. Investments in bonds may decline in value due to rising interest rates, a real or perceived decline in credit quality of the issuer, borrower, counterparty, or collateral, adverse tax or legislative changes, court decisions, market or economic conditions. High-yield bonds are subject to greater credit risk, default risk, and liquidity risk.

Before investing in any fund offered by Aquila Group of Funds, carefully read about and consider the investment objectives, risks, charges, expenses, and other information found in the fund’s prospectus. The prospectus is available from your financial professional, by clicking here or calling 800-437-1020.