Taxable Municipal Bonds grabbed the attention of not only municipal bond market participants in 2020, but also of investors and financial professionals globally across the asset class landscape.

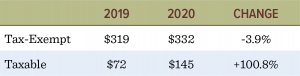

Nationally, new issue volume growth was confined to the burgeoning taxable municipal bond sector, where issuance doubled from $72.2 billion in 2019 to $145.2 billion in 2020. By comparison, tax-exempt issuance in the municipal bond market declined slightly from $354 billion to $328 billion.

The eye-popping issuance figures for taxable municipal securities made headlines throughout the year. The $145 billion of new taxable municipal bonds were issued as fully Federally taxable, but in most cases, retained the applicable  state tax exemption. This accounted for almost one third of all municipal bonds issued and ultimately accounted for the entire increase in total issuance in 2020. The prominent rise of this mechanism in the municipal market occurred as a consequence of the component of the 2017 Tax Cuts and Jobs Act which eliminated tax-exempt advance refunding of tax-exempt issues.

state tax exemption. This accounted for almost one third of all municipal bonds issued and ultimately accounted for the entire increase in total issuance in 2020. The prominent rise of this mechanism in the municipal market occurred as a consequence of the component of the 2017 Tax Cuts and Jobs Act which eliminated tax-exempt advance refunding of tax-exempt issues.

Questioning The Tax Exemption – Again

With taxable municipals accounting for such a prominent slice of state and local government borrowing there has been growing speculation in the financial press, and among market participants, about what this means for traditional tax-exempt financing. Common viewpoints gaining traction have called into question the need for traditional tax-exemption in municipal finance and even suggested the success of taxable issuance in 2020 proves municipal bonds can exist without the tax-exemption.

This speculation has been fueled by a number of misperceptions about the municipal bond market and the nature of public finance. The explosion in taxable issuance ultimately resulted from the confluence of two watershed developments:

• The arbitrary prohibition of the advance refunding mechanism that had been a staple of municipal finance for 100 years.

• Generational lows in benchmark U.S. Treasury yields off of which the yields of other taxable securities are “spread” by a variety of taxable investors.

What these developments ultimately point to is the simple continuation of the old fashioned resourcefulness of the nation’s municipal finance officials: optimizing the borrowing costs of their taxpayers and constituents, rather than a long-run steady state “transformation” of the municipal bond market.

Tax Cuts and Jobs Act – Where It All Began

The 2017 Tax Cuts and Jobs Act (TCJA) was signed into law on December 22, 2017. It was hailed as significant tax reform, primarily for its reduction in marginal individual income tax rates, although its “significance” seems muted compared to the 1986 Reagan-style tax reform that dropped top rates from 50% to 28%. Of greater impact to the municipal market was its provision that prohibited the advance refunding of tax-exempt securities with proceeds from tax-exempt issues.

Because of the nature of municipal finance, issuers structure bonds with discrete future redemption dates to enable potential refinancing savings to be achieved from potential future reductions in interest rates. Advance refunding (not the same as a current redemption) enables municipalities to capitalize on the availability of present interest rate savings and facilitates a practice that consumers can accomplish with a variety of debt instruments (mortgages, credit cards) – the ability to refinance at will.

What Was Cheap is Now Expensive

The tax-exempt borrowing costs of many bonds issued in the last 3-8 years would at the time of issuance been considered inexpensive in the context of the overall interest rate environment – but definitely not in 2020. Ordinarily, without the availability of the advance refunding mechanism, municipal finance officers could only watch and wait for the redemption date to arrive – and hope borrowing costs stayed low.

However, the staggering decline in U.S. Treasury yields to generational lows over the past two years opened a unique window of opportunity. Now the yields of high-quality corporate bonds taxable investors normally buy have dropped to a point where municipalities could sell bonds with a similar straightforward taxable yield that was well below their legacy tax-exempt costs.

The arbitrage between the higher cost of outstanding tax-exempt debt, and the costs of issuing taxable debt at today’s taxable market yields, is what has ultimately enabled issuers to continue advance refunding their bonds prior to their first call date – and reap savings for municipalities and taxpayers alike.

The Taxable Municipal Issuance Boom – A Creature of Opportunity

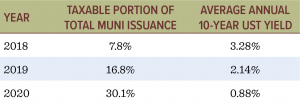

The confluence of these developments has led to a surge in the issuance of taxable refunding issues over the past three years:

The movement in benchmark U.S. Treasury yields to generational lows in 2020 created an increasingly significant window of opportunity for municipal issuers to issue federally taxable debt in order to advance refund outstanding higher cost bonds.

Taxable Refunding of Tax-Exempts Revs Up

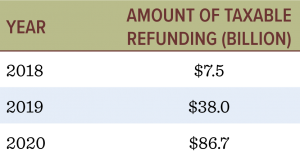

The issuance of taxable bonds by municipalities to refund outstanding debt has grown by over 1,000% in the last two years:

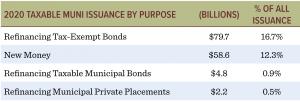

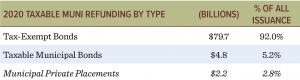

A breakdown of the 2020 taxable refinancing volume and new money volume provides a glimpse into the nuanced difference not just among municipal bonds, but between municipal and corporate bonds:

Outside of refunding activity, taxable municipal bond issuance for new spending purposes was only 12% of total issuance. A look at muni bond issuance since 2003 shows that taxable municipals have always occupied a small corner of the muni market.

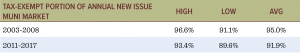

Taking away the periods when taxable volume was heavily influenced by the Build America Bond program years in 2009-10 and the TCJA induced refunding years of 2018-2020, traditional tax-exempt issuance that financed core public finance purposes were the dominant form of capital raising by towns and governments in the debt markets:

Even though practice and use of taxable municipals has garnered more attention the past decade, its use as a tool of public infrastructure finance policy historically has been situational at best.

The taxable bond phenomenon has led to the introduction of a new class of investors such as foreign buyers and taxable institutions like pension funds to U.S. municipal issuers. This has potentially created a better match between:

1) investors that have greater experience assessing balance sheet-driven borrowing purposes or who have long duration liabilities to match – making them more willing than risk-averse individuals to engage long duration fixed income risks.

2) Municipal issuers with less conventional financing needs such of problematic unfunded pension obligations or more private sector related projects that can’t attain a tax-free legal opinion.

“Adventure Capital” in the Municipal Bond Market

A breakdown of the taxable refunding volume in 2020 sheds light on private placements, a small portion of the municipal market that can land the asset class in the financial press. Existing taxable bonds accounted for 8% of the amount of taxable refunding issues. This was commensurate with the composition that taxable municipals comprised of historical overall muni issuance the past two decades.

A breakdown of the taxable refunding volume in 2020 sheds light on private placements, a small portion of the municipal market that can land the asset class in the financial press. Existing taxable bonds accounted for 8% of the amount of taxable refunding issues. This was commensurate with the composition that taxable municipals comprised of historical overall muni issuance the past two decades.

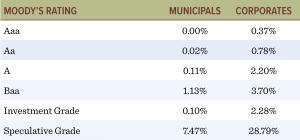

The category of municipal private placements usually consists of well-intentioned projects. Although, these are issues whose economic viability though is solely a function of income and tax revenue projections in feasibility studies, or appraisal valuations of existing assets being acquired. These kinds of “project finance” issues can also be found in publicly offered taxable and tax exempt municipal bond issues and, for the most part, are more speculative in nature and bear no resemblance to core public finance borrowing purposes. While these issues can be riskier and generally account for the lion’s share of outstanding muni bonds that show up in default statistics, they can prove to be valuable investments for those who do their research.

The Essential Tax-Exempt Municipal Bond Market

This distinction points to the inherent economic differences between the corporate bond market and the municipal bond market, and explains the difference between the historically low default rate of municipals and the default rate of their same-rated corporate bond counterparts.

Corporate bonds are primarily a tool of “risk capital” used to finance projects, business lines, and balance sheet considerations that are intended to create profits and enhance company valuations. Municipal bonds however are the primary tool with which states, towns, and local governments implement public infrastructure policy. According to the Municipal Securities Rulemaking Board (MSRB), two thirds of infrastructure projects built in the Unites States are in fact financed by municipal bonds.

The schools, hospitals, utilities, and transportation resources vital to a community’s standard of living could not be affordably built without the public finance tool of municipal bond financing. These community and civic resources are typically long-term assets that often require long-term financing. The proceeds from municipal bond issuance provides a stable, reliable pool of capital that results in a very efficient and optimal cost of borrowing thanks to the tax-exempt aspect of the interest paid.

Going forward the popularity and feasibility of taxable bonds as a tool of public finance for municipalities will remain dependent on both the general level of interest rates and any adjustment/reversal of Federal policy on tax-exempt advance refunding rules. Until either of these change, don’t count out traditional tax-exempt financing just yet.

This material is provided for informational and educational purposes only, and is not intended as an offer or solicitation for the purchase or sale of any financial instrument, or any Aquila Group of Funds product. References to specific asset classes and financial markets are for illustrative purposes only and should not be considered recommendations or investment advice.

Investments in bonds may decline in value due to rising interest rates, a real or perceived decline in credit quality of the issuer, borrower, counterparty, or collateral, adverse tax or legislative changes, court decisions, market or economic conditions. Fund performance could be more volatile than that of funds with greater geographic diversification.

Pre-refunded/Escrowed bonds are issued for the purpose of retiring or redeeming an outstanding bond issue at a specified call date. Until the call date, the proceeds from the bond issuance are typically placed in a trust and invested in US Treasury bonds or state and local government securities. Non-rated bonds are holdings that have not been rated by a nationally recognized statistical rating organization. Spread refers to the difference between two prices, rates or yields. A private placement is a bond deal that is structured and issued to pre-selected investors and institutions rather than on the open market.