On November 8, 2022, Colorado voters will be faced with approximately $1.3 billion of K-12 municipal issuance in 12 school district elections. In addition, Colorado voters will be deciding on a variety of propositions, including:

• Proposition 121, a statewide ballot measure to reduce the state income tax rate

• Proposition 123, which seeks to dedicate revenue to affordable housing.

Proposition Overviews

Proposition 121 would reduce the state income tax rate from 4.55% to 4.40%. Its potential passage could reduce state income tax revenue by $412.6 million in fiscal year 2022-23.

Proposition 123 would set aside up to 0.1% of annual income tax revenue from Colorado’s general fund for affordable housing programs. The passage of Proposition 123 could reduce state income tax revenue from the general fund by $145 million in fiscal year 2022-23, and by $290 million in fiscal year 2023-24.

Local School District Bond Issues

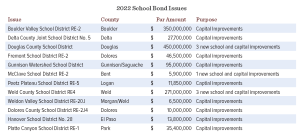

Unlike at the State level, which has experienced difficulty in passing tax increases, Colorado voters have historically shown a willingness to approve local bond measures. These issues are used to finance new schools and other capital improvements throughout the State. School district bond issues on this year’s ballot range in size, from approximately $5.9 million to as much as $450 million. Depending on voter sentiment, this election could potentially impact local municipal bond supply and opportunities for investors.

Source: Kirkpatrick Pettis Capital Management, Colorado Secretary of State and Colorado School Finance Project

Source: Kirkpatrick Pettis Capital Management, Colorado Secretary of State and Colorado School Finance Project

The information is general in nature and is not intended to provide investment, accounting, tax or legal advice. It is not intended to represent a recommendation or solicitation related to any particular investment, security or industry sector. The opinions shared are those of the author and do not necessarily reflect those of the Investment Adviser of the Fund.

Mutual fund investing involves risk; loss of principal is possible. Investments in bonds may decline in value due to rising interest rates, a real or perceived decline in credit quality of the issuer, borrower, counterparty, or collateral, adverse tax or legislative changes, court decisions, market or economic conditions. State-specific fund performance could be more volatile than that of funds with greater geographic diversification.

Before investing in the Fund, carefully read about and consider the investment objectives, risks, charges, expenses and other information found in the Fund prospectus. The prospectus is available from your financial professional, by clicking here, or by calling 800-437-1020.