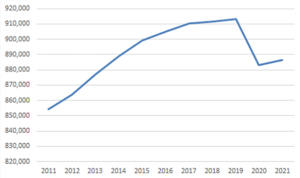

Each year, October 1st is the day that Colorado counts students to determine the per-pupil funding amount each school district will receive from the State. As a matter of perspective, school enrollment in Colorado was at an all-time high in the fall of 2019, and then the COVID-19 pandemic hit. Fall 2020 school enrollment for grades PK-12 declined by 30,000 students, the first decline in 30 years. Homeschooling doubled to almost 16,000 students, while private school enrollment fell by 6,000 students. Fast forward to fall 2021, when school enrollment was slightly higher, by 3,000 students, as homeschooling fell by 5,000 students, and private school enrollment increased by 4,000 students with students returning to the classroom (see exhibit below)

Colorado PK-12 Student Fall Enrollment History

Source: Colorado Department of Education

Preliminary Fall 2022 Enrollment Data

School district general obligation bonds are supported by property taxes and have historically been relatively stable during economic downturns. Fall 2022 school enrollment data are scheduled to be published in January 2023. Preliminary enrollment data for the two largest school districts—Denver Public School and the Jefferson County School District—show a continuing trend of declining enrollments. The State’s analysts attribute lower birth rates, poverty and high housing prices for lowering school enrollments in larger school districts. Even though each county’s populations increased, the number of school age children in each county has fallen, as birth rates declined. Most counties saw their birth rates peak in the late 2000s, but, Boulder, Denver and Jefferson counties birth rates peaked in 2001.

Potential Impact on Colorado Public Schools

Denver Public Schools has said it expects to lose 3,000 students over the next four years—an annual loss of $36 million. Denver Public Schools was helped by $69.8 million in CARES Act funding in fiscal year 2020, and $22.8 million in ESSER I funds in fiscal year 2021. Denver Public Schools is due to receive an additional $304.5 million in federal aid in fiscal years 2022 and 2023.

Denver Public Schools has opened 142 schools and closed 60 in the last 20 years. Denver is planning on closing schools with enrollment below 215 students, and schools with an enrollment of 275 with a forecast enrollment decline of 8-10% over the next two years. No charter schools are forecast to be closed.

Jefferson County Public Schools is targeting schools with fewer than 250 students. Almost 20% of Jefferson County’s 84 elementary schools use less than 60% of their building’s capacity. Most of these schools are near their border with Denver and have a higher poverty level. Projections show elementary enrollment to decline at 43 elementary schools and increase at 38 elementary schools over the next few years.

Conclusion

Property tax collections in Colorado have historically been robust and property values have continued to appreciate. Even as enrollments are decreasing in some areas, these districts continue to see assessed values rise, and general fund balances that continue to increase, which helps mitigate the decline in enrollments. Given the stability of the property tax-funded revenue model, in our opinion, we do not see any material immediate credit risks for school district general obligation bonds.

A significant component of our credit review process is to prepare a detailed credit report on each of the portfolio holdings. These reports highlight the credit features and potential deficiencies that inform our investment decisions, particularly during volatile times. As of this writing, a significant portion of the portfolio is allocated to school district general obligation bonds, which rely upon property taxes for repayment, so we’re closely monitoring this issue. Employing a locally-based investment approach, the Fund’s investment team is able to provide “on-the-ground” perspectives on local developments such as this. Stay tuned for further updates.

The information is general in nature and is not intended to provide investment, accounting, tax or legal advice. It is not intended to represent a recommendation or solicitation related to any particular investment, security or industry sector. The opinions shared are those of the author and do not necessarily reflect those of the Investment Adviser of the Fund.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act was an emergency assistance bill approved in 2020 in response to the COVID-19 pandemic.

The CARES Act established the Education Stabilization Fund, which initially provided funding to the Elementary and Secondary School Emergency Relief (ESSER) I Fund. ESSER I Fund amounts were appropriated to states based on their Title I shares.

Mutual fund investing involves risk; loss of principal is possible. Investments in bonds may decline in value due to rising interest rates, a real or perceived decline in credit quality of the issuer, borrower, counterparty, or collateral, adverse tax or legislative changes, court decisions, market or economic conditions. State-specific fund performance could be more volatile than that of funds with greater geographic diversification.

Before investing in the Fund, carefully read about and consider the investment objectives, risks, charges, expenses and other information found in the Fund prospectus. The prospectus is available from your financial professional, by clicking here, or by calling 800-437-1020.