Mutual fund managers evaluate many characteristics of potential investment opportunities. The investment team at Aquila Group of Funds evaluates a wide range of characteristics, and puts a particularly high value on three distinct criteria: material positive changes, strong business models, and attractive valuations. In addition, the team seeks to identify “moats” that may protect certain companies from competition. In this article, we explore the role of moats in contributing to business model strength and sustained profitability.

The Role of Moats from a Business Perspective

Oxford Advanced American Dictionary defines a moat as “a deep, wide channel dug around a castle, etc. and filled with water to make it more difficult for enemies to attack.” For investors analyzing the medium and long-term potential profitability of companies’ business models, moats are the business characteristics that help shield companies from attack by competitors.

In our view, there are five broad categories of moats that help companies protect their long-term profitability from competition:

-

- Strong brand

- Protected intellectual property

- Protected license

- Market position

- Resource advantage

Companies may have more than one kind of moat, but one is typically the primary source of its business model strength.

Types of Moats

1. Strong Brand

The first moat we consider is a strong brand. Brands encompass intangible reputation, as well as printed images and other symbols that convey the reputation of a product or service. In many cases, companies seek trademarks to provide legal protection for their brands. The goal of a brand is to create brand loyalty and raise the lifetime value of the customer relationship. As a result, a highly regarded brand can help drive sustained unit sales growth and pricing power, both of which contribute to earnings growth over time.

One example of a strong brand that provides a moat is the Ford Motor Company (F) F-Series. It has been America’s best-selling vehicle for 40 consecutive years. The F-Series is now in its fourteenth generation, and Ford sold over 700,000 F-Series trucks in 2021, almost 30% higher than the second most popular vehicle sold in the U.S. The F-Series traces its history to workhorse vehicles purchased by construction workers and farmers who needed them to do their jobs. Today, the F-Series is a versatile and reliable vehicle that fills suburban driveways where owners shuttle families, and haul home improvement projects. The vehicle has a reputation for reliability with each new generation, undergoing 10 million miles of testing before it is offered for sale.

In 2022, Ford will be rolling out its much anticipated fully-electric F-150 Lightning pickup truck, and 200,000 reservations were made within seven months of it being unveiled. The Ford F-Series’ brand reputation drives demand, which in turn, supports sales and profit forecasts that contribute to longer term cash flow prospects of the company versus its automaker peers.

Another compelling brand example is Caesars Entertainment, Inc. (CZR). For Americans of a certain generation, Caesars, which opened in 1966, is one of the most iconic brands—one they may think of first when it comes to gambling and casinos. According to YouGovAmerica brand research, it is one of the top three most recognized casino brands. Caesars is leveraging its brand to take share in online sports and casino betting, and in the U.S., is the only company succeeding in both the physical and digital markets.

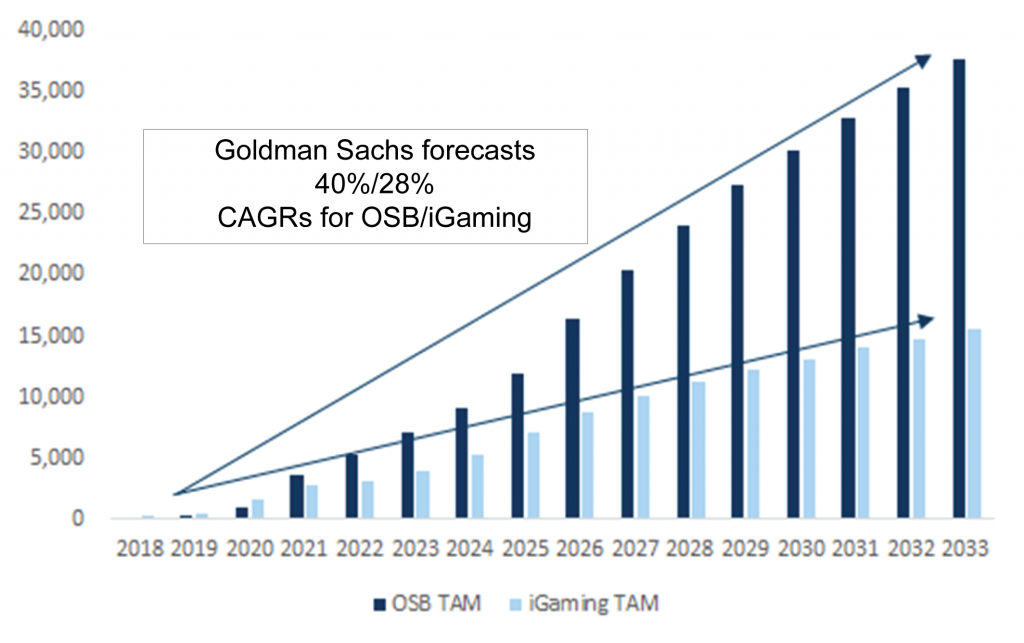

Recently, Caesars grew its market share in the online/mobile sports betting market to 21% from nearly zero just a few years ago. Goldman Sachs anticipates online sports betting and iGaming to experience significant growth over the next decade (see Exhibit 1). Caesars’ strong brand should help maintain its market position. Furthermore, Caesars’ online business should contribute to the company’s profitability over the same period.

Exhibit 1 – Online Sports Betting and iGaming Forecasts

Source: Goldman Sachs, Bureau of Economic Analysis & State Gaming Commissions

Both Ford and Caesars’ strong brands provide moats that help protect their businesses from competition.

2. Protected Intellectual Property

Intellectual Property (“IP”) is an intangible asset that is owned and legally protected by a company from outside use without consent. Intellectual property protection provides assurances that certain creations of human intellect should be given the same protective rights that apply to physical property. Patents, copyrights and trademarks are all examples of protected intellectual property. If a company owns valuable IP, it can require competitors to compensate it for access to its intellectual property, generating earnings and cashflow. Alternatively, companies with protected IP can refuse to share their knowledge and protected property, enabling them to offer customers superior products that can gain market share and receive a premium price in the market.

One example of a company with valuable intellectual property is Arista Networks (ANET). Arista Networks has become the de facto leader for commercial networking solutions for the most demanding hyperscale networking environments. Their infinitely scalable and extensible software and hardware solutions leave behind the legacy, outdated, and brittle codebases that their competitors are required to support for their large installed customer bases.

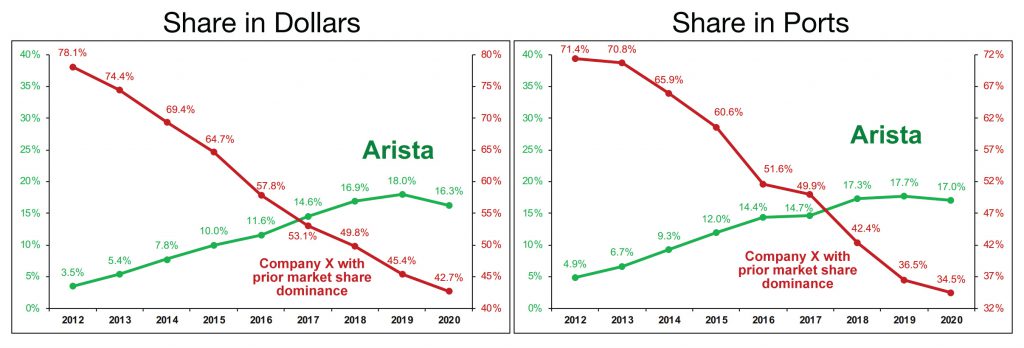

Arista has many patents and other forms of IP that have allowed them to move ahead of their larger competitors in the fastest growth segments of the market and gain significant market share in revenues and units (see Exhibit 2). In our opinion, Arista’s protected IP will contribute to revenue and profit growth, providing a moat of protection from its competitors.

Exhibit 2 – Arista Networks’ Market Share

Source: Crehan Research Datacenter Switch Market Share Report Q4’2020

Note: 10GbE and Higher – Excludes blade switches

Other examples of companies with valuable IP moats include Synopsys, Inc. (SNPS) and Cadence Design Systems (CDNS), both of which benefit from their extensive suite of semiconductor design, IP license, and testing solutions. If an engineer wants to design a performant chip, electronic solution, and/or an embedded hardware and software design, they have little choice but to turn to either Synopsys or Cadence for digital and analog (respectively) design, simulation, test, and IP solutions. Growth has accelerated at both companies from the low single-digit to low double-digit range over the past decade, as their customer base has broadened from traditional semiconductor companies to hyperscalers, automotive, industrial, and system providers.

With the slowing of Moore’s Law, the only way companies can evolve their solutions is through a custom stack of silicon all the way to the application software suite. Moore’s Law states that chip performance generally doubles every two years at approximately half the price. As a result, we believe the protected IP and know-how of both companies support above-industry-average long-term growth.

3. Protected License

Licenses are often very difficult and costly to acquire and can be valuable assets because they control who is allowed to operate in or supply to a market. To this end, licenses can provide a moat that is a formidable barrier of entry for competitors to overcome.

One type of license is approval for standard treatment by the U.S. Food and Drug Administration (“FDA”) to treat a disease. Seagen Inc., formerly Seattle Genetics, Inc. (SGEN) is a leader in the discovery and development of antibody-drug therapies that facilitate the targeted delivery of cytotoxic payloads to destroy cancer cells. Their FDA-approved drugs include: 1) Adcetris, the standard frontline therapy treatment for Hodgkin lymphoma; 2) Padcev, which is used to treat metastatic urothelial cancer; and 3) Tukysa, a best-in-class metastatic breast cancer treatment. All three drugs are approved by the FDA, with multiple patents and licenses, allowing Seagen to be the exclusive manufacturer until 2031. These licenses enable Seagen to market and sell therapies to patients who suffer from these illnesses, providing the company with highly visible earnings and cash flow streams.

Another type of license granted by the U.S. government is one to export weapon systems to foreign countries. AeroVironment, Inc. (AVAV) designs, develops, and produces small unmanned aircraft and fast charge systems for electric industrial vehicle batteries. It produces Switchblade loitering missile systems that enable combatants to easily launch, fly, track, and target armored vehicles with lethal effects while minimizing collateral damage. The missiles are rapidly deployable and highly maneuverable, with high-performance optics and scalable munition payloads.

AeroVironment has acquired the requisite U.S. government license to sell Switchblade loitering missile systems to foreign countries under the Arms Export Control Act and International Traffic in Arms Regulation. AeroVironment also holds the patent for the “wave-off” technology. This feature allows an operator to cancel an attack within seconds of impact to avoid collateral damage and minimize civilian casualties during wartime efforts. The U.S. government license and patent protection allows AeroVironment to be the exclusive manufacturer and exporter of the Switchblade loitering missile systems to countries in the North Atlantic Treaty Organization (“NATO”). These export licenses are difficult to acquire and help provide a moat that supports the sustainability of AeroVironment’s business model.

4. Market Position

Market position refers to market share and leadership. It can be a highly valuable intangible asset, especially in industries where first-mover advantage, or dominant market share, leads to adoption up and down a supply chain. Aside from their years-ahead design, test, and verify tool suites, both Synopsys and Cadence’s products have attained such a large percentage of market share at key customers in each segment that the entire supply chain has essentially standardized their designs and products around both companies’ intellectual property.

In select markets, such as digital synthesis or analog design, it is considered to be very difficult for Synopsys to dislodge Cadence and vice-versa (see Exhibit 3; data outlined in red). Given the industry’s adoption of both companies’ models as a standard and their work to support that, a competitor introduction would have to be multiple times better just to be considered, which makes for unattractive research and development return on investment for any potential challengers.

Exhibit 3 – Electronic Design Automation (“EDA”) – Market Position

Source: Rosenblatt Securities Research

5. Resource Advantage

A resource advantage can be a commodity or natural resource that is in the ground (e.g., lithium mine or oil field), but can also be a resource such as a unique distribution channel, or a sales force that is difficult to replicate. Resource advantages may be nearly insurmountable by potential competition, or they may just help to secure dominant market share or margins.

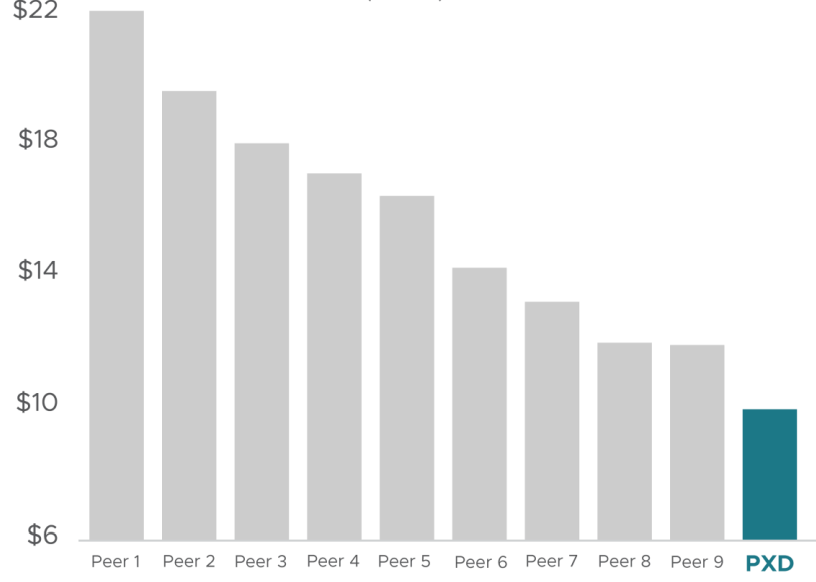

One example of a resource advantage can be found at Pioneer Natural Resources (PXD), an independent oil and gas exploration company. Pioneer is the largest acreage holder in the Spraberry/Wolfcamp field in the Permian Basin, with the majority of their acreage footprint in the core of the Midland Basin in West Texas. According to Pioneer, these resources are in one of the most productive basins in North America, which gives Pioneer a massive drilling inventory, with production costs currently under $20 per barrel, and cash production costs of under $10 per barrel. This acreage is a significant resource advantage because it provides the company with a broad and deep moat that protects it against competitors whose production costs are significantly higher. As a result, Pioneer can drill and profit in a wider variety of energy market environments and achieve higher margins than peers with less productive acreage assets.

Exhibit 4 – Cash Costs of Production for Pioneer Versus North American Peers ($/Barrel of Oil Equivalent)

Source: Pioneer (Cash costs, based on Q3 2021 Company Filings. Peers include: APA, CLR, EOG, DVN, FANG, HES, MRO, OVV and OXY).

Another example is Hess Corporation (HES), a New York-based independent energy company focused on the exploration, development, production, and sale of oil, natural gas, and liquids. Hess has a resource advantage over many of its competitors in the form of a low-cost offshore development project in Guyana led by Exxon Mobil, and in which Hess has a 30% interest. This consortium in Guyana affords Hess long-term cash flow growth potential that we expect will materially increase over time as the project is further developed.

Conclusion

In summary, a key aspect of a strong business model is a moat that protects a company from its competition. The five moats discussed help businesses fend off competitors, and potentially generate higher earnings and cash flows than those that do not have the same protective characteristics.

From an investment perspective, identifying companies that have moats is an important part of the stock selection process because they can contribute to medium or long-term stability or growth in profitability. The investment team at Aquila Group of Funds look at moats in the context of overall business model strength that consider factors such as profitability and balance sheet strength. Other characteristics we weigh heavily in our investment decisions include attractive valuations and material positive changes. Of course, investors should consider their individual financial goals, their time frame for achieving them, and their tolerance for risk. Working with a financial professional who understands your investment objectives and long-term financial goals, can help you invest appropriately.

This material is not intended to be a recommendation or investment advice, and does not constitute a solicitation to buy, sell or hold a security or an investment strategy. The views and opinions expressed are for informational and educational purposes only as of the date of writing and may change without notice at any time based on numerous factors, such as market or other conditions, legal and regulatory developments, and additional risks and uncertainties.

Securities of the companies referenced were portfolio holdings of Aquila mutual funds as of the writing of this article. Following is a listing of the companies per fund, represented as a percentage of the funds’ total portfolio as of 6/30/22:

Aquila Opportunity Growth Fund: AeroVironment, Inc.: 0.98%; Arista Networks: 1.97%; Cadence Design Systems: 1.26%; Caesar’s Entertainment, Inc.: 1.12%; Ford Motor Company: 1.71%; Hess Corporation: 1.85%; Pioneer Natural Resources: 1.56%; Seagen Inc.: 0.87%; Synopsis, Inc.: 2.12%.

Aquila High Income Fund: Caesar’s Entertainment, Inc.: 3.62%; Ford Holdings LLC: 1.00%; Ford Motor Credit Co. LLC: 0.90%.

Information regarding holdings is subject to change and is not necessarily representative of a fund’s entire portfolio. A complete list of portfolio holdings, including percentage allocations, for any of the funds offered by Aquila Group of Funds is available at www.aquilafunds.com, or by calling 800-437-1020.

Past performance does not guarantee future results.

Mutual fund investing involves risk, which includes but is not limited to: potential loss of principal, market risk, financial risk, interest rate risk, credit risk, and investments in highly-leveraged companies, lower-quality debt securities, and foreign markets and currencies.

Before investing in any mutual fund offered by Aquila Group of Funds, carefully read about and consider the investment objectives, risks, charges, expenses, and other information found in the Fund’s prospectus. The prospectus is available from your financial advisor, when you visit www.aquilafunds.com, or call 800-437-1020.