As the Federal Reserve (“the Fed”) continues its trek to tamper down historically high inflation through monetary policy tightening, the fixed income markets have experienced unprecedented challenges, highlighting a risk many bond investors rarely considered over the past 40+ years of the bond bull market. Over the last few decades, fixed income investors were periodically reminded that credit risk could create potential rough spots in a portfolio, whether driven by sector weakness, such as the energy price decline in 2008, or issue-specific, idiosyncratic risk caused by poor corporate management decisions or misguided business plans.

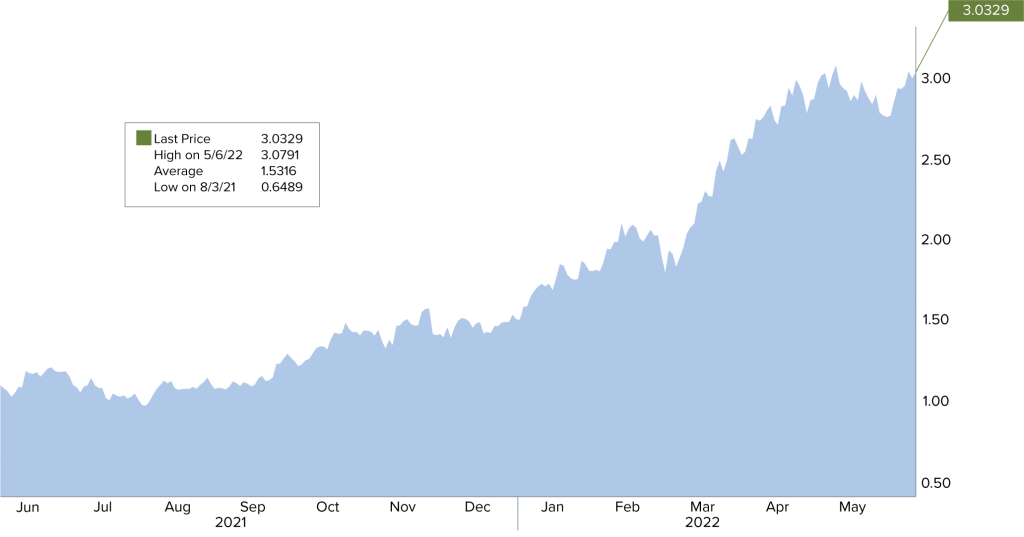

However, interest rate risk didn’t usually present itself in any sustainable fashion until recently, or at least at this pace and level of severity. Lately, we’ve witnessed yields increase at a seemingly break-neck pace. This is evidenced in the chart below (Exhibit 1), highlighting the yield on the 5-year U.S. Treasury note over the last 12 months. In reaction to Fed policy becoming more restrictive over the next few quarters, the 5-year Treasury yield has moved from a recent low of 0.65% in early August 2021 to a high of 3.03% in June 2022—a truly remarkable increase of 238 basis points in less than 12 months.

EXHIBIT 1 – 5-YEAR U.S. TREASURY YIELD

Source: Bloomberg Index Services Limited

Duration and Interest Rates

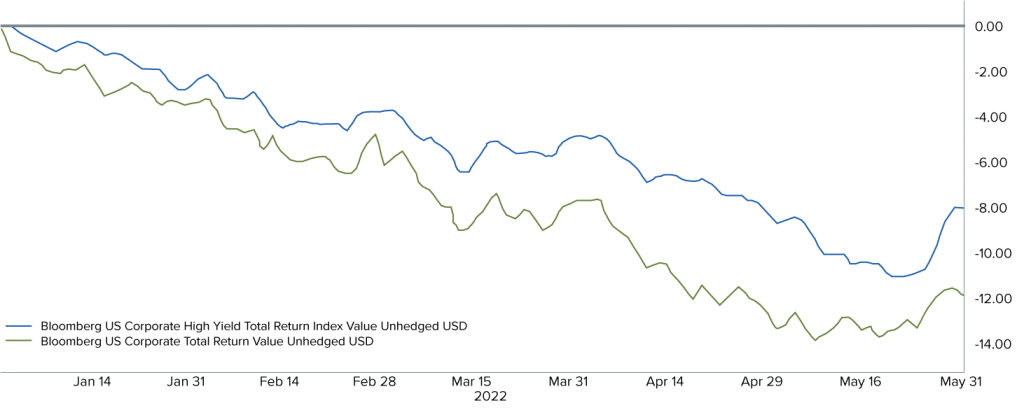

Duration, which is a measure of the sensitivity of the price of a bond to a change in interest rates, has become the focal point of discussion for many fixed income investors as rates have risen sharply. Simply put, the higher (or longer) the duration of an asset, the more price sensitive that asset tends to be in relation to a change in yields. With the price of bonds having an inverse relationship to yield, fixed income securities with a very long duration suffered the most during this recent rise in rates. This was most apparent in reviewing performance of the investment-grade corporate bond market, which has seen its duration extend dramatically over the last 5-10 years, as corporate treasurers locked in attractive financing for longer periods. As a point of reference, the Bloomberg U.S. Corporate Bond Index has a duration as of this writing of approximately 7.7 years, which is up from about 5.5 years in 2000. This resulted in the Index posting a year-to-date total return of -11.9% through 5/31/22. However, due to the unique nature of the high-yield bond market, which generally has a lower duration, this asset class has held up well on a relative basis in 2022, with a total return of -8.0% through the end of May, as represented by the Bloomberg U.S. Corporate High Yield Index (see Exhibit 2).

EXHIBIT 2 – PERFORMANCE: HIGH-YIELD vs. INVESTMENT GRADE BONDS

Source: Bloomberg Index Services Limited

The Role of High-Yield Bonds as a Portfolio Diversifier

High-yield companies tend to issue bonds with shorter (5-7 year) maturities and generally have a call feature, which allows the issuer to pay off the bonds well before the final maturity—hence keeping the overall weighted-average duration of the Index well below the investment-grade corporate bond benchmark. Therefore, with a moderate duration of just over four years, and higher coupons and yields to offset recent price declines, investors looking for a fixed income product to diversify their portfolios may choose to consider this asset class.

Although inflation will likely remain stubbornly high for the remainder of 2022, and the Federal Reserve maintains a vigilant response through continued monetary tightening, the current income available in the high-yield market and its manageable duration may allow the fixed income sector to weather the storm better than most bonds. Corporate balance sheets still remain well-anchored, while default rates for lower-rated credits have seen only a very modest uptick in recent months and have stayed well below the longer-term average of 3.2%, according to JPMorgan.

Considerations for Investors

Generally speaking, during rising interest rate cycles, bonds with shorter maturity and duration tend to experience lower price fluctuation compared with longer-term bonds. As rates continue to rise and overall financial conditions become more challenging, high-yield investing—particularly through active portfolio management, using in-depth credit analysis and well-constructed duration strategies—may help investors avoid potential “land mines,” while generating attractive, high current income. Of course, past performance cannot be a predictor for the future, and you should be sure to understand and evaluate the financial markets and related conditions before making any investment decisions.

At Aquila Group of Funds, we believe it is important to not let your emotions overtake your investment plan, especially during periods of uncertainty. A common mistake that investors make is to allow fear or uncertainty keep them from participating in financial opportunities, rather than sticking with their intended plans. Thus, try to remain focused on your individual financial goals, your time frame for achieving them, and your tolerance for risk. Now may be an opportune time to speak with a financial professional to review your investment portfolio to ensure it aligns with your individual goals.

This is for informational purposes only and not intended to represent a solicitation to buy or sell any particular investment, security or industry sector.

Past performance does not guarantee future results.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy of completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith.

Mutual fund investing involves risk; loss of principal is possible. Investments in bonds may decline in value due to rising interest rates, a real or perceived decline in credit quality of the issuer, borrower, counterparty, or collateral, adverse tax or legislative changes, court decisions, market or economic conditions.

Before investing in any fund offered by Aquila Group of Funds, carefully read about and consider the investment objectives, risks, charges, expenses, and other information found in the Fund’s prospectus. The prospectus is available from your financial professional, by clicking here or calling 800-437-1020.