The current investment team overseeing Aquila High Income Fund celebrated its one-year anniversary at the helm on October 1, 2022. Bringing more than a century of combined investment experience to Aquila, Portfolio Managers David Schiffman and Pedro Marcal, along with Research Analysts John McPeake and Steven Yang, established a comprehensive, top-down and bottom-up management approach to high-yield investing. This article provides a review of the investment team’s initial 12-month period (ended 9/30/22), as well as a look ahead to 2023.

Active Portfolio Management

Upon joining Aquila Group of Funds, the investment team performed an in-depth, bottom-up credit analysis of all positions held at that time. The team also conducted a comprehensive portfolio review related to credit quality weightings, duration exposure and yield curve positioning. Incorporating a thorough top-down focus, the team slightly restructured the portfolio to enhance underlying credit quality, maintain a slightly lower duration bias compared to its benchmark, and improve the optionality profile of the portfolio to avoid extension risk in anticipation of a rising rate environment. In making the portfolio adjustments mentioned, the team executed on its overall theme of “Do no harm”—what has become a mantra for Aquila’s high-yield strategy and is consistent with the conservative investment strategy our shareholders have grown to expect.

Extensive experience across the entire high-yield corporate bond universe, including dedicated coverage of specific industry sectors, enabled the team to identify certain portfolio holdings that, in the team’s view, could be eliminated due to credit fundamentals. Below is a summary of key portfolio changes:

- Companies that the team believed were vulnerable from a credit fundamental perspective included Carvana Co. (CVNA), CommScope (COMM), Rackspace Technology, Inc. (RXT) and loanDepot Inc. (LDI).

- Meanwhile, a rigorous macroeconomic review and analysis led the team to increase the Fund’s energy exposure.

- As a result, companies such as Occidental Petroleum Corporation (OXY), Crestwood Equity Partners LP (CEQP), and New Fortress Energy Inc. (NFE) were added to the portfolio, which the team believed all had stable-to-improving credit metrics.

These are just some of the examples of key portfolio changes made during the past year. Portfolio holdings are subject to change and a complete list of current holdings can be obtained by contacting Aquila Group of Funds (see ‘Important Disclosures” referenced below).

Higher Interest Rates and Changing Economic Conditions

By early-2022, our conviction of inflation being more than “transitory” drove us to prepare the portfolio for a higher rate environment. With yields expected to move rapidly and consistently higher due to the Federal Reserve’s efforts to manage inflation, we reduced exposure to some longer duration assets, and used proceeds to purchase non-callable bonds with shorter maturities (generally less than six months). This strategy offset the natural duration extension of the portfolio, as callable bonds began trading to later call dates or maturity during the rising rate environment. It also afforded the team an opportunity to reinvest the proceeds from these short maturities into higher-yielding securities, as the Federal Reserve (the “Fed”) executed its aggressive monetary tightening policy. This kept the portfolio’s duration about a year shorter than its benchmark and reduced the overall price volatility during this exceptionally tumultuous period.

As the Fed became more steadfast in taming inflation in early-Summer and into the Fall, it became clear to the investment team that higher interest rates might push the U.S. economy into a possible recession. Since Fed rate hikes historically operate with a long and variable lag, we began to prepare the portfolio for a weakening economy by moving up in credit quality and reducing exposure to the lowest-rated sector of the high-yield market. This “up in quality” strategy resulted in an underweight position in CCC-rated bonds, which performed relatively poorly over the 12-month period ended 9/30/22 versus the Bloomberg U.S. Corporate High Yield Index (-18.4% and -14.1%, respectively).

Entering the fourth quarter of 2022, the investment management team identified a number of economic indicators that are pointing toward a potential recession in 2023. As of this writing, the yield differential between the 2-year U.S. Treasury note and 10-year U.S. Treasury note reached a level (-76 basis points) not seen since the early 1980s. It is widely viewed that this type of yield curve inversion could foreshadow an economic recession. While there can be no assurances, such yield curve inversions preceded economic downturns in 1980, 1981, 1990, 2001 and 2008 (see Figure 1).

Exhibit 1 – Past Economic Recessions Following U.S. Treasury Yield Curve Inversions

Sources: Bloomberg, Federal Reserve, Haver, SMBC. Past performance does not guarantee future results.

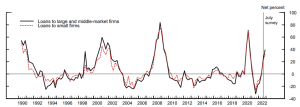

Other anecdotal evidence of a potential recession can be seen by the recent tightening of lending standards. According to a recent Fed survey, the proportion of U.S. banks tightening terms on loans for medium-to-large businesses and commercial real estate rose during Q3 2022 to a level usually seen during a recessionary period (see Figure 2).

Exhibit 2 – Net Percent of Domestic Respondents Tightening Standards for Commercial and Industrial Loans

Source: The Federal Reserve. Past performance does not guarantee future results.

Source: The Federal Reserve. Past performance does not guarantee future results.

In addition, lending standards on credit cards and other consumer loans have become much more restrictive, combining to put additional pressure on both consumers and businesses. Finally, as the Fed remains diligent in its fight against inflation, we expect the federal funds rate (the interest rate that banks charge each other to borrow or lend excess reserves overnight) to eventually peak around 5.25% to 5.50%, while maintaining this level for the foreseeable future, as Federal Reserve Chairman Jerome Powell and his colleagues wait for the long and variable lags of recent hikes to work its way through the system. As such, we expect some companies to experience negative operating leverage due to substantially lower growth, which has yet to be priced into many risk assets.

Looking Forward

We are confident that the Fund is well-positioned for uncertainties the market faces as we end 2022 and begin the new year. With a defensive interest rate risk posture, through lower duration and a portfolio leaning towards higher-rated credits, we believe Aquila High Income Fund is structured to help weather potential volatility. That said, our nimbleness and dedicated sector coverage should enable the team to identify attractive opportunities and relative value, as the economy hopefully bounces back from what we expect to be a fairly shallow economic downturn and a re-allocation to risk assets in 2023, and beyond.

Admittedly, a substantial amount of uncertainty exists in today’s markets. While Chairman Powell has indicated that the Fed’s fight against inflation may result in some near-term challenges for both individuals and businesses, many economists still hold out hope for a “soft landing” for the economy. With the ongoing war in Ukraine, continued supply-chain bottlenecks, China’s zero-COVID policy, and inflation still running rampant across the globe, it is difficult to predict the precise timing, depth and length of a potential economic downturn.

However, the substantially higher rates we see in the high-yield market, compared to those at the end of 2021 (8.82% versus 4.21%, respectively), offer a compelling opportunity for investors, in our opinion. While credit spreads have not yet priced in a recession, they have widened appreciably over the last year and are getting closer to levels that might be appropriate for a soft landing, or a mild downturn in 2023. Hence, with a yield for the Bloomberg U.S. Corporate High Yield Index approaching 9%, and the potential for capital appreciation, high-yield corporate bonds could be an attractive investment consideration for investors looking to earn high current income and enhance risk-adjusted total return.

Important Disclosures:

This material is not intended to be a recommendation or investment advice, and does not constitute a solicitation to buy, sell or hold a security or an investment strategy. The views and opinions expressed are for informational and educational purposes only as of the date of writing and do not reflect those of the Investment Adviser of the Fund. They may change without notice at any time based on numerous factors, such as market or other conditions, legal and regulatory developments, and additional risks and uncertainties.

Securities of the companies referenced were portfolio holdings of Aquila High Income Fund as of the writing of this article. Following is a listing of the companies, represented as a percentage of the Fund’s total portfolio as of 9/30/22: Occidental Petroleum Corporation: 2.05%; Crestwood Equity Partners LP: 1.92%; New Fortress Energy Inc.: 3.00%. Information regarding holdings is subject to change and is not necessarily representative of the Fund’s entire portfolio. A complete list of portfolio holdings, including percentage allocations, for any of the funds offered by Aquila Group of Funds is available at www.aquilafunds.com, or by calling 800-437-1020. Past performance does not guarantee future results.

Modified and effective duration both measure the value of a security in response to a change in interest rates. Effective duration also takes into account the effect of embedded options.

A credit spread or a yield spread is the difference between the quoted rates of return on two different investments, usually of different credit qualities but similar maturities. Independent rating services (such as Standard & Poor’s, Moody’s and Fitch) assign ratings, which generally range from AAA (highest) to D (lowest), to indicate the credit worthiness of the underlying bonds in the portfolio. Where the independent rating services differ in the rating they assign to an issue, or do not provide a rating for an issue, the highest available rating is used in calculating allocations by rating.

The Bloomberg U.S. Corporate High Yield Index is a rules-based, market-value-weighted index designed to measure publicly issued, non-investment grade, dollar-denominated fixed-rate, taxable and corporate bonds. Indices are unmanaged and are not available for direct investment. Past performance does not guarantee future results.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy of completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith.

Mutual fund investing involves risk; loss of principal is possible. Investments in bonds may decline in value due to rising interest rates, a real or perceived decline in credit quality of the issuer, borrower, counterparty, or collateral, adverse tax or legislative changes, court decisions, market or economic conditions. High-yield bonds are subject to greater credit risk, default risk, and liquidity risk.

Before investing in any mutual fund offered by Aquila Group of Funds, carefully read about and consider the investment objectives, risks, charges, expenses, and other information found in the Fund’s prospectus. The prospectus is available from your financial advisor, when you call 800-437-1020 or click here.