The current investment team overseeing Aquila Opportunity Growth Fund celebrated its one-year anniversary managing the Fund on October 1, 2022. Upon their arrival, Lead Portfolio Manager Pedro Marcal and Co-Portfolio Manager John McPeake—each with over 25 years of industry experience—implemented a change-focused, fundamental research process. Pedro and John believe that some of the most attractive investments can be found in companies benefitting from a material positive change. These are companies that have strong business models, which enable them to monetize these changes into higher earnings and cashflow, and where the impacts of the positive change may not yet be recognized or valued by the market.

Critical to the investment team are Research Analysts David Schiffman and Steven Yang, industry veterans with nearly 50 years of combined experience. The team has worked together closely even prior to joining Aquila Group of Funds. Together, the investment team provides dedicated coverage across all of the 11 industry sectors within the mid-cap universe, which is the primary focus of Aquila’s equity strategy. This article provides a review of the investment team’s initial 12-month period (ended 9/30/22), as well as a look ahead to 2023.

Active Portfolio Management

Upon joining Aquila Group of Funds, the investment team conducted a thorough review of the portfolio positions held at the time. They assessed the upside potential of each stock that was held in the Fund, carefully evaluating the respective sector and market characteristics reflected in the holdings, and repositioned the portfolio accordingly. Employing a strict sell discipline, the team eliminated positions in companies whose limited upside in their view did not justify the inherent risk associated with each position.

The team selected names they believed to benefitting from material positive change, while repositioning the Fund’s industry weightings to better align with expectations for rising interest rates and energy prices. Below is a summary of key portfolio changes:

- The team increased the Fund’s weighting in Banks that they felt would benefit from a rising interest rate environment, as well as Energy companies that may benefit from elevated oil and gas prices and increasing refinery margins.

- In the Technology area, the team raised the Fund’s Software weighting and added exposure to what they believed were some of the Technology sector’s fastest growing and most profitable segments, such as electronic design automation and Cloud computing.

- Concerns about the sustainability of increased consumer expenditures caused the team to underweight the Consumer Discretionary sector.

- Expectations for higher inflation and interest rates led the team to underweight the Real Estate, Home Builders and Consumer Durables sectors.

These are just some of the examples of key portfolio changes made during the past year. Portfolio holdings are subject to change and a complete list of current holdings can be obtained by contacting Aquila Group of Funds (see “Important Disclosures” referenced below).

Changing Economic and Market Conditions

Markets were volatile in the fourth quarter of 2021, and, in hindsight, we may have been witnessing the peak of an equity bull market, created in part by the massive monetary and fiscal policy response to the COVID-19 crisis in the United States. During the quarter, positive news included the reappointment of Federal Reserve Chairman Jerome Powell, and strong corporate profits despite manufacturing supply chain problems. Conversely, inflation began to increase, with the monthly Consumer Price Index’s year-over-year increase continuing to climb—from September’s 5.4% to 6.2%, 6.8% and 7.0% in the months of October, November and December 2021, respectively. Additionally, markets at the beginning of Q4 2021 expected the COVID-19 situation to improve, but then the highly contagious Omicron variant arrived in force. Investors breathed a sigh of relief again when it appeared to be less severe than previous variants.

By early-2022, additional inflation data began to be reported, which confirmed the team’s view that inflation was more than “transitory.” This led the team to continue to adjust the portfolio in anticipation of a higher rate environment, along with a slowing economy and corporate profits. Inflation accelerated into the first quarter of 2022, with monthly Consumer Price Index increases up in January, February and March by 7.5%, 7.9% and 8.5%, respectively. During Q1, Russia invaded Ukraine, driving oil prices to a peak of $123.70 per barrel of West Texas Intermediate (“WTI”) crude oil on 3/8/22.

The Federal Reserve (the “Fed”) began increasing the federal funds rate (the interest rate that banks charge each other to borrow or lend excess reserves overnight) and gave guidance that it intended to reduce its balance sheet by $95 billion per month. Separately, China continued to implement its zero-COVID policy, locking down Shanghai and creating massive port congestion that impacted the supply chain for manufactured products globally. Unsurprisingly, two of three largest contributors to performance in the quarter were Oil Exploration companies, and the third was in the Banking sector.

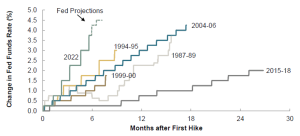

During the second quarter of 2022 and continuing into the third quarter, several unfavorable developments impacted equity markets. The Fed demonstrated its intention to fight inflation and raised rates more aggressively and rapidly in comparison to prior rate hike cycles (see Exhibit 1).

Exhibit 1 – Changes in the Federal Reserve Funds Rate

Source: Bloomberg, Federal Reserve, SMBC Nikko. Past performance does not guarantee future results.

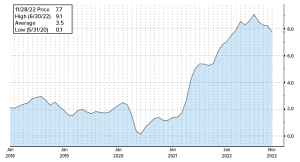

Additionally, the Federal Reserve also began the process of shrinking its balance sheet as inflation remained elevated (see Exhibit 2).

Exhibit 2 – Monthly Consumer Price Index

Source: Bloomberg and U.S. Bureau of Labor Statistics. Past performance does not guarantee future results.

Looking Forward

During Q2 2022, equity markets were volatile and fell 16.1%, as measured by the S&P 500 Index. Since federal monetary policy historically affects the real economy, with a lag of 12-18 months, the actions by the Federal Reserve to tighten financial conditions in the first three quarters of 2022 is likely begin to impact the U.S. economy in 2023.

Investors who assumed that the Fed would provide support to the equity markets after such a dramatic drop helped rally the market in the third quarter of 2022. That was until Chairman Powell dispelled this notion during his speech August 26th entitled “Monetary Policy and Price Stability.” At that time, he again articulated his intentions to bring inflation back down to a range of 2%. Mr. Powell’s messages and resolve corrected the misperception of Federal Reserve support and caused stocks to finish with a return of -4.88% for Q3, as measured by the S&P 500.

As we head into 2023, we continue to be optimistic about the opportunities the market offers, albeit cautious optimism. The investment team seeks to add alpha and outperform the prevailing market, as commensurate with a careful approach to risk management. We strive to achieve this through a disciplined investment process that includes well-researched stock selection, a rigorous sell discipline, and nimble portfolio repositioning in the face of evolving market and macroeconomic fundamentals.

Important Disclosures:

This material is not intended to be a recommendation or investment advice, and does not constitute a solicitation to buy, sell or hold a security or an investment strategy. The views and opinions expressed are for informational and educational purposes only as of the date of writing and do not reflect those of the Investment Adviser of the Fund. They may change without notice at any time based on numerous factors, such as market or other conditions, legal and regulatory developments, and additional risks and uncertainties.

The Consumer Price Index is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services, providing a common measure of inflation in the United States.

The S&P 500 Index measures the value of stocks of the 500 largest corporations by market capitalization listed on stock exchanges in the United States. Indices are unmanaged and are not available for direct investment. Past performance does not guarantee future results.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy of completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith.

Information regarding holdings is subject to change and is not necessarily representative of the Fund’s entire portfolio. A complete list of portfolio holdings, including percentage allocations, for any of the funds offered by Aquila Group of Funds is available at www.aquilafunds.com, or by calling 800-437-1020.

Mutual fund investing involves risk; loss of principal is possible. Investment risks include, but are not limited to, potential loss of value, market risk, financial risk, interest rate and credit risk, and investments in highly-leveraged companies, lower-quality debt securities, foreign markets and foreign currencies.

Before investing in any mutual fund offered by Aquila Group of Funds, carefully read about and consider the investment objectives, risks, charges, expenses, and other information found in the Fund’s prospectus. The prospectus is available from your financial advisor, when you call 800-437-1020, or when you click here.